AutoCount SST

Chapter 3: Government SST Tax Code

3.1 Tax Code Listing (Output Tax)

Sales tax listings

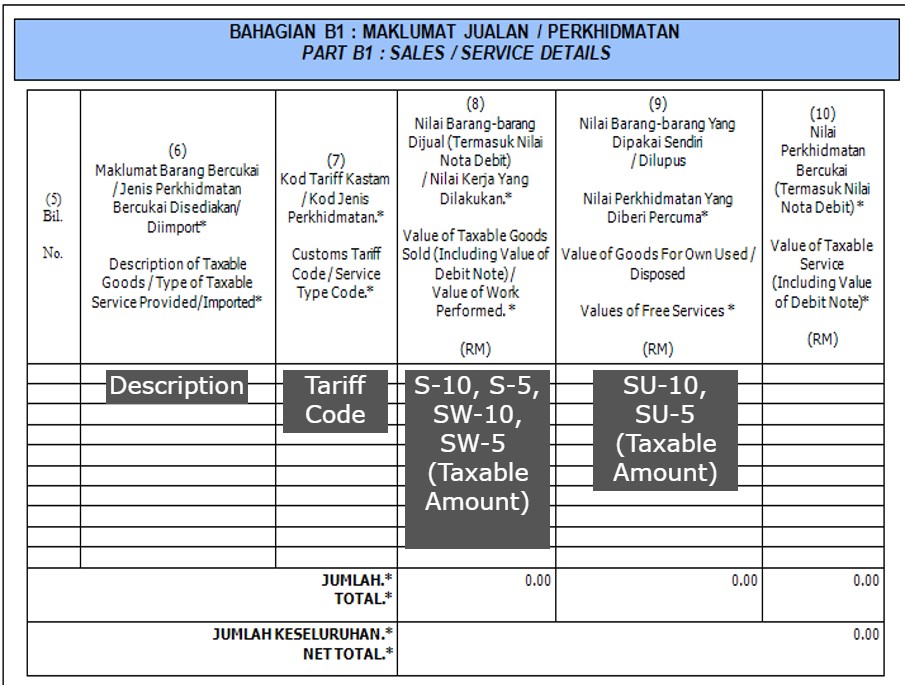

| UD Tax Code | RMCD Tax Code | Tax Rate | Description | GL Acc | Note | SST-02 |

| S-10 | S-10 | 10% | Sales Tax | Sales Tax | Goods manufactured in Malaysia or imported with 10% tax | 8, 11b 13 (cn) |

| S-5 | S-5 | 5% | Sales tax | Sales Tax | Goods manufactured in Malaysia or imported with 5% tax | 8, 11a 13 (cn) |

| SV-6 | SV-6 | 6% | Service Tax | Service Tax | Malaysia services subject to 6% tax | 10, 11c 13 (cn) |

| SW-10 | SW-10 | 10% | Work Performed Sales Tax | Sales tax | Manufactured goods or imports subject to 10% sales tax | 8, 11b 13 (cn) |

| SW-5 | SW-5 | 5% | Work Performed Sales Tax | Sales Tax | Manufactured goods or imports subject to 5% sales tax | 8, 11a 13 (cn) |

| SU-10 | SU-10 | 10% | Own Used/Disposed Sales tax | Sales Tax | Own Used/Disposed goods manufactured with 10% sales tax | 9, 11b 13 (cn) |

| SU-5 | SU-5 | 5% | Own Used/Disposed Sales Tax | Sales Tax | Own Used/Disposed goods manufactured with 5% sales tax | 9, 11a 13 (cn) |

| SVU-6 | SVU-6 | 6% | Own Used/Disposed Service Tax | Service Tax | Own Used of services subject to 6% service tax | 9, 11c 13 (cn) |

| S-0 | 0% | Sales Tax 0% | Nil | Goods made in Malaysia or imported with 0% sales tax | ||

| SV-0 | 0% | Service Tax 0% | Nil | Malaysia service supply exempt from tax | ||

| EEM | EEM | 0% | Sales to Export Market | Nil | Export of goods outside Malaysia | 18a |

| ESP | ESP | 0% | Sales to Special Area | Nil | Goos supplied from Malysia to Special Area, including free zone, licensed warehouse, licensed manufacturing warehouse & Joint Development Areas | 18a |

| EDA | EDA | 0% | Sales to Designated Area | Nil | Goods supplied from Malaysia to Designated Area, including Pulau Langkawi, Labuan & Pulau Tioman | |

| ESA | ESA | 0% | Exemption Schedule A | Nil | Exemption Goods and persons from sales tax under Schedule A | 18b1 |

| ESB | ESB | 0% | Exemption Schedule B | Nil | Exempted good acquired by unregistered manufacturers for producing specific products are sales tax-exempt | 18b2 |

| ESC-A | ESC-A | 0% | Exemption Schedule C Item 1 & 2 | Nil | Registered manufacturers can import/purchase exempt raw materials, components, and packaging materials from sales tax under Schedule C, excluding petroleum for Item (1) & (2) | 18b3(i) |

| ESC-B | ESC-B | 0% | Exemption Schedule C Item 3 & 4 | Nil | Goods exempt from sales tax under Shcedule C include raw materials & components for registered manufacturers, including petroleum products, when imported /purchased by authorized representatives | 18b3(ii) |

| ESC-C | ESC-C | 0% | Exemption Schedule C Item 5 | Nil | Exemptions apply for registered manufacturers sending semi-finished/finished taxable goods for subcontract work, avoiding sales tax | 18b3(iii) |

| ESV-6 | ESV-6 | 0% | Exemption Service Tax | Nil | Supply of services exempted from payment of service tax | 18c |

| EME | EME | 0% | Exemption Under Approved Major Exporter Scheme (AMES) | Nil | Supply of goods that are exempted under AMES, section 61A of the Sales Tax Act 2018 | 18d |

Purchase tax listings

| UD Tax Code | RMCD Tax Code | Tax Rate | Description | GL Acc | Note | SST-02 |

| P-10 | P-10 | 10% | Purchase Tax 10% | Transaction Account | Goods purchased from SST registered suppliers with 10% sales tax | |

| P-5 | P-5 | 5% | Purchase Tax 5% | Transaction Account | Goods purchased from SST registered suppliers with 5% sales tax | |

| PS-6 | PS-6 | 6% | Purchase Service Tax | Transaction Account | Services purposed from SST registered suppliers with 6% service tax | |

| SD-4 | SD-4 | 4% | Sales Tax Deduction | Transaction Account | Registered manufacturers can claim a 4% sales tax deduction on taxable goods with a 10% sales tax rate | 13b |

| SD-2 | SD-2 | 2% | Sales Tax Deduction | Transaction Account | Registered manufacturers eligible for sales tax deduction can receive a 2% deduction on purchases taxed at 5% | 13b |

| DS-6 | DS-6 | 6% | Digital Service Tax 6% Claimable | Digital Service Tax Claimable Account | Digital Service Tax paid to foreign service provider and is allowed to claim a refund granted under Section 34 (3)(b) Service Tax Act 2018 | 13c |

| DSN-6 | DSN-6 | 6% | Digital Service Tax 6% Not Claimable | Transaction Account | Digital Service Tax paid to foreign service provider | |

| IMSV-6 | 0% | Purchase Imported Services from supplier | Nil | Special tax code in Purchase Invoice/AP Invoice to records imported services, triggering Journal Entry for service tax | ||

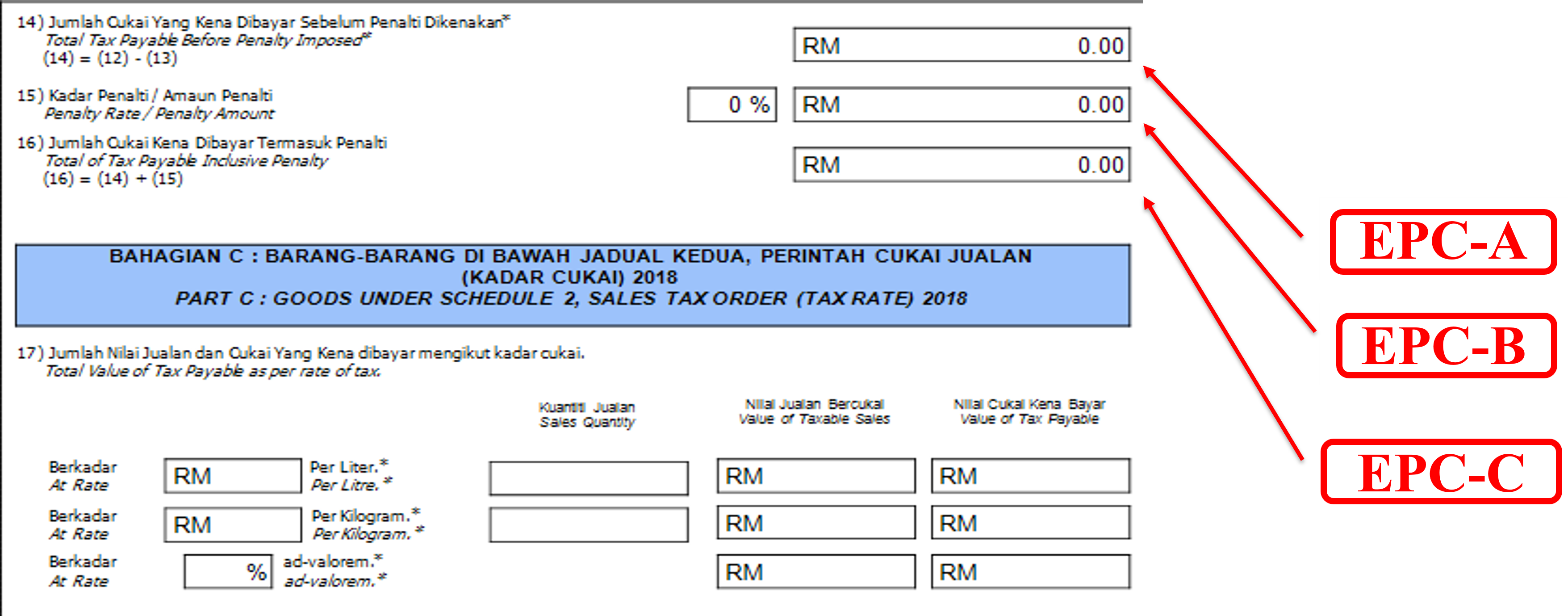

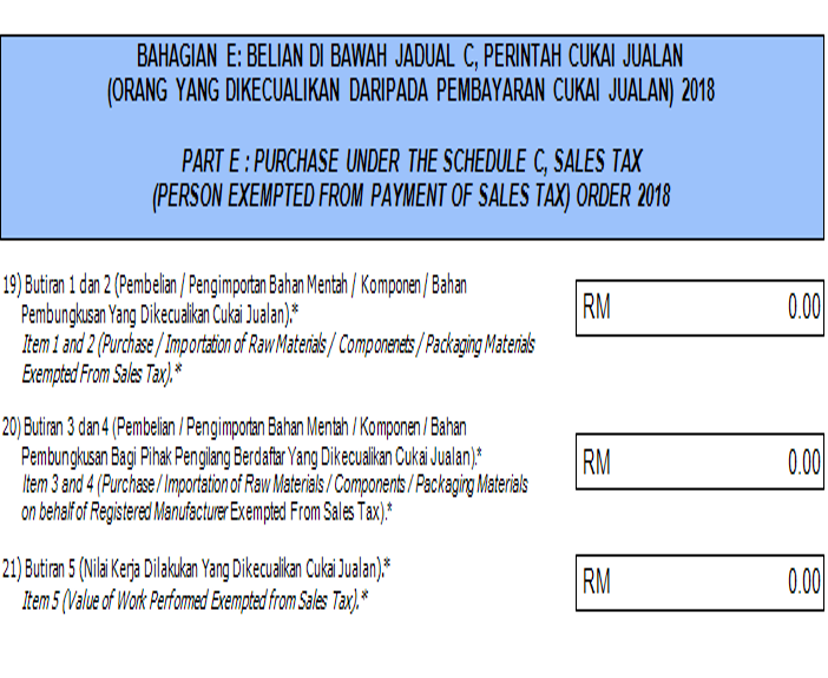

| EPC-A | EPC-A | 0% | Exemption Purchase Schedule C Item 1 & 2 | Nil | Registered manufacturers can umport/purchase exempt raw materials, components, & packaging materials without sales tax, specifically excluding petroleum | 19 |

| EPC-B | EPC-B | 0% | Exemption Purchase Schedule C Item 3 & 4 | Nil | Goods exempt from sales tax under Schedule C include raw materials, components, & packaging for registered manufacturers, applicable to both general goods & petroleum products on their behalf | 20 |

| EPC-C | EPC-C | 0% | Exemption Purchase Schedule C Item 5 | Nil | Registered manufacturers can send semi-finished/finished taxable goods for subcontract work, exempt from sales tax upon return | 21 |

Exemption Service Tax

View Tax Code Listings in AutoCount

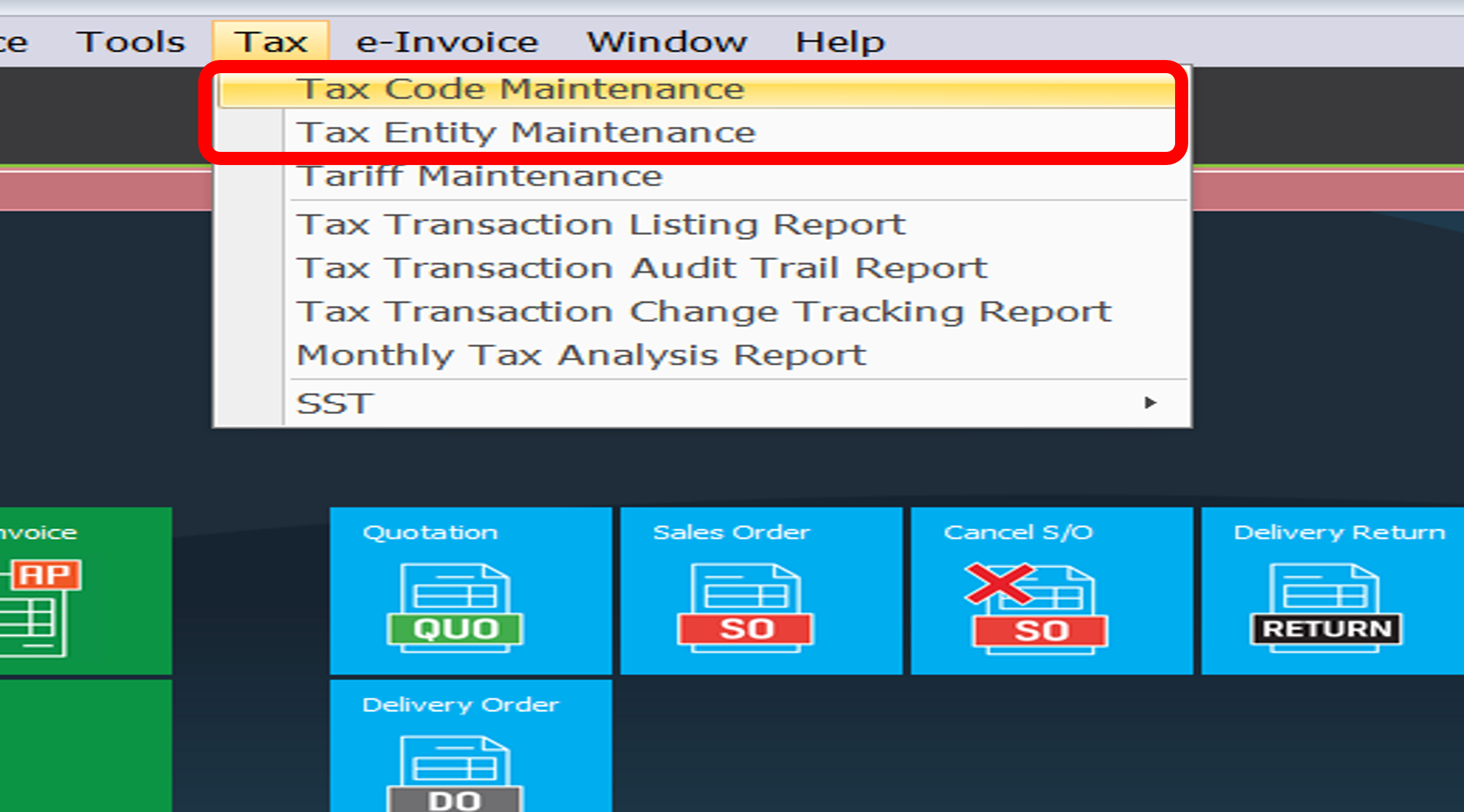

Tax > Tax Code Maintenance

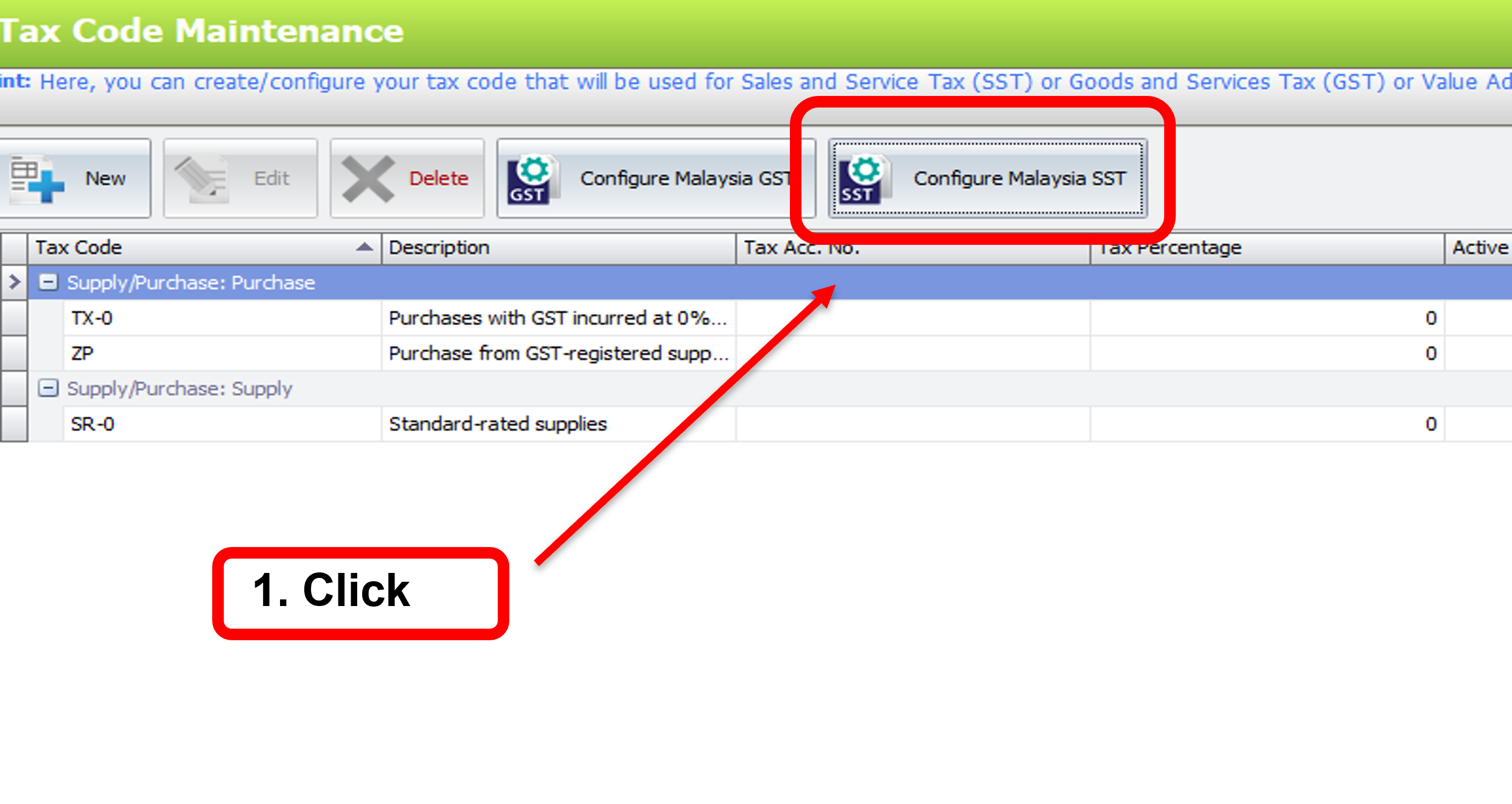

Click Configure Malaysia SST

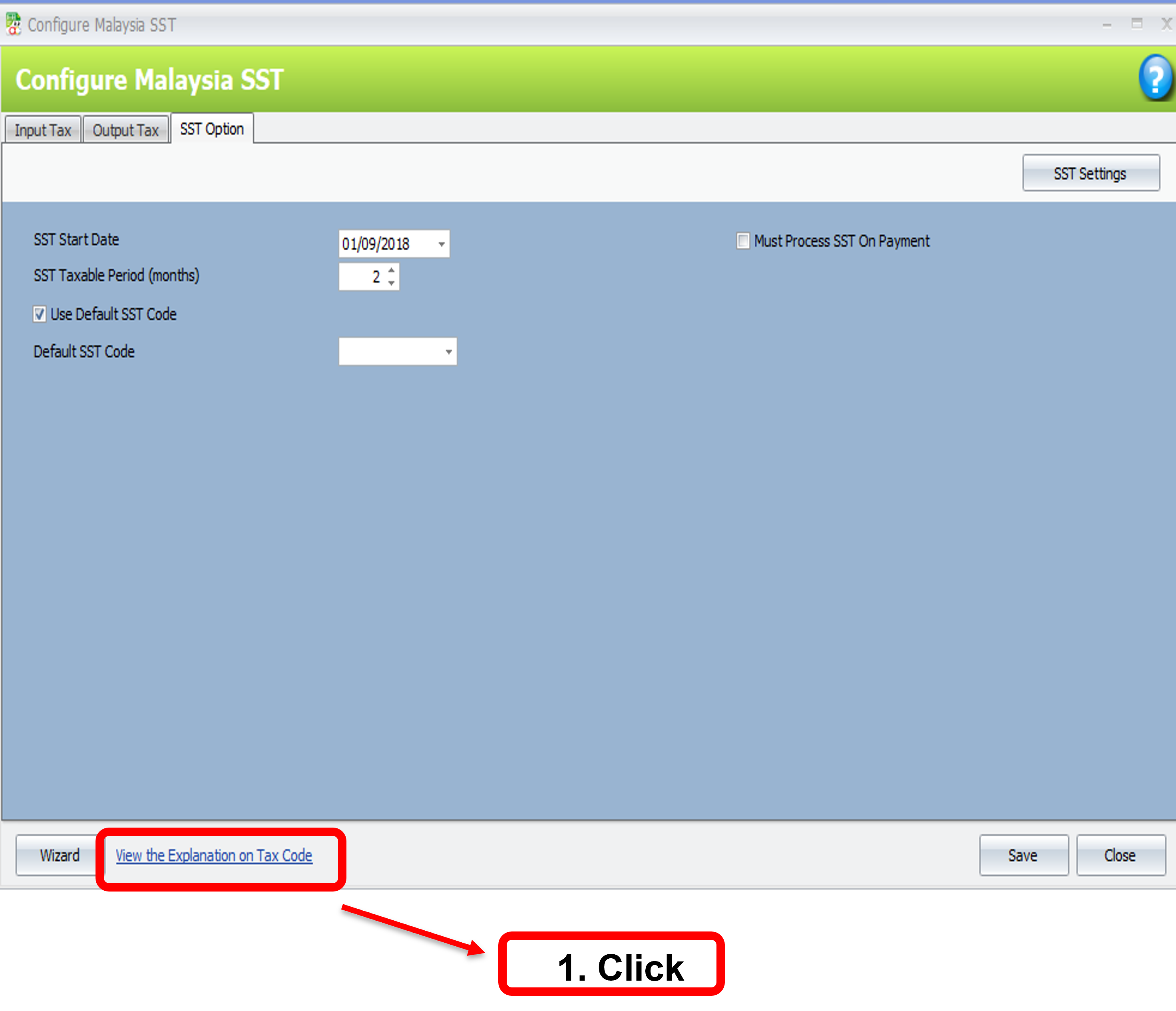

SST Option > Click “View the Explanation on Tax Code”

You can check the Tax Code Listing here

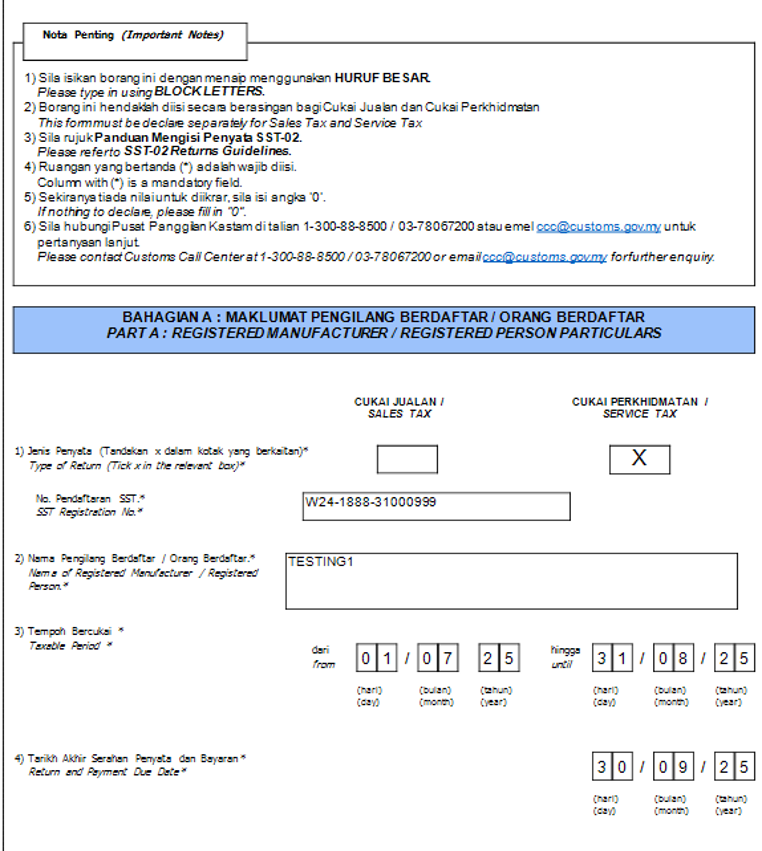

3.2 SST 02 Form Mapping (Sales Tax)

Tax > SST (1) > SST Instant Info (2)

SST Instant Info:

- Allows you to simulate SST for a certain taxable period

- It will generate the results based on your available transactions

- Will not process SST

- Just for an overall view of SST condition

Then, click SST-02 (Sales)

| A | a) S-5, SU-5, SW-5 b) S-10, SU-10, SW-10 |

| B | Taxable Amount |

| C | Tax |

| D | CN S-5, SW-5, SU-5, SU-10, SW-10, SU-10 |

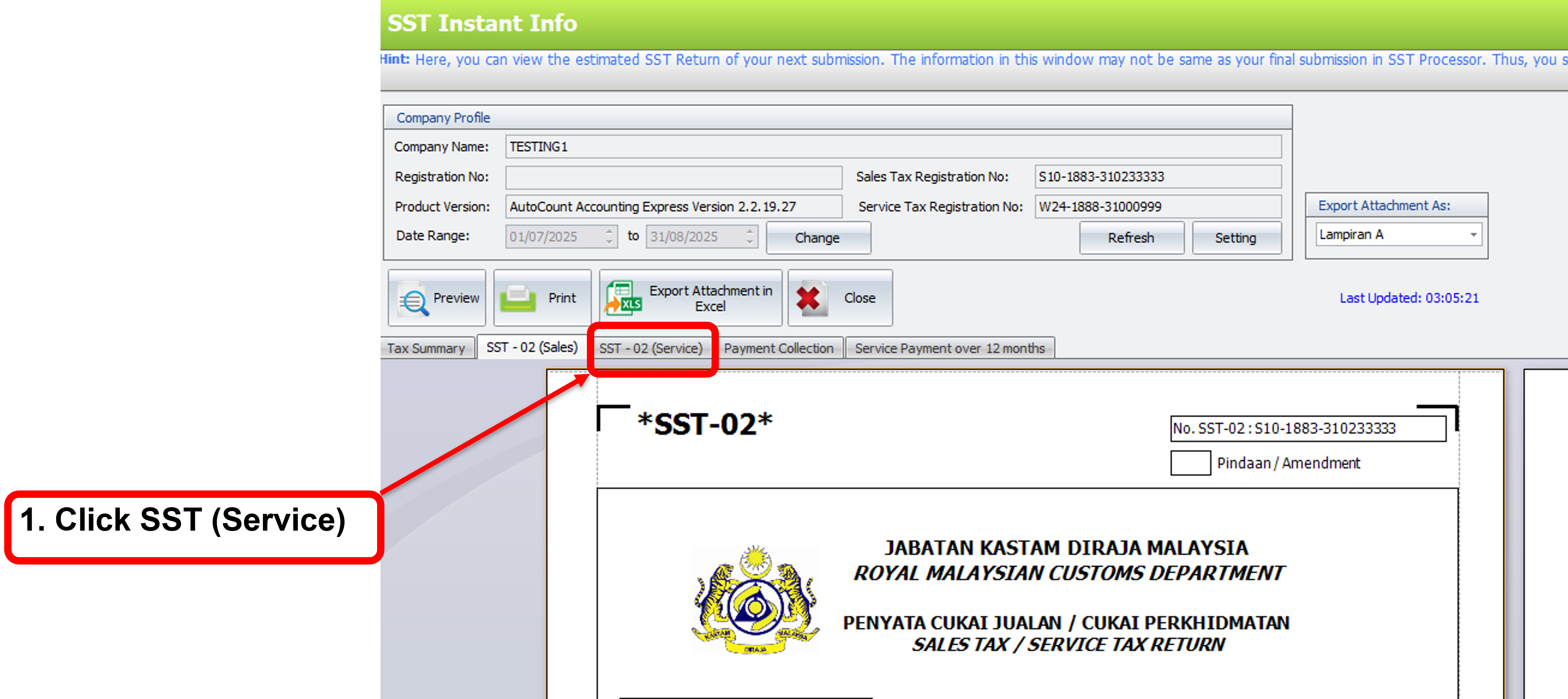

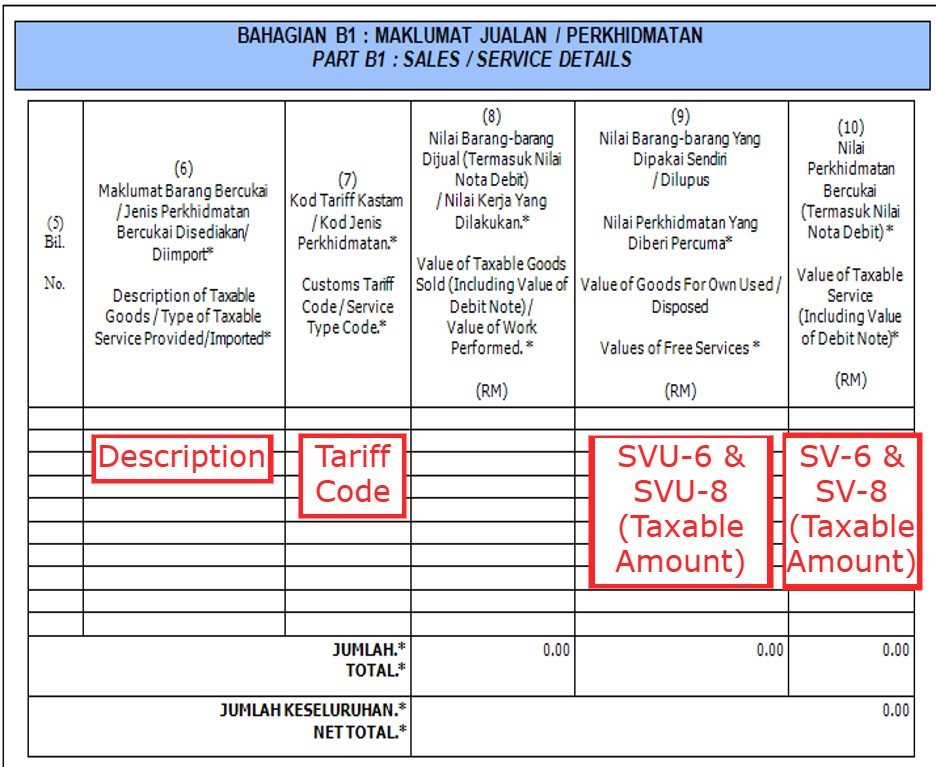

3.3 SST 02 Form Mapping (Services Tax)

Tax > SST (1) > SST Instant Info (2)

Click “SST-02(Service)”

REMARK* – Section B2: Value of Tax Payable

| Old Version | Item 11(c) covered Taxable Services at 6% and 8% combined. Item 11(d) covered Taxable Services Item 1, Group H |

| New Version | Item 11(c) now only covers Taxable Services at 6% Item 11(d) added Taxable Services at 8%. Previous is numbered as 11(e) |

| Example | A company provides consultancy services (8% SST) worth RM412, 127.22

|

Section B2: New Item 13(d)

| Old Version | No reporting line for Bad Debt Relief |

| New Version | Item 13(d) added “Total Tax Value of Bad Debt Relief” |

| Example | If a company previously charges RM50, 000 SST but later wrote off the invoice as bad debt, this can now be disclosed separately under Item 13(d) |

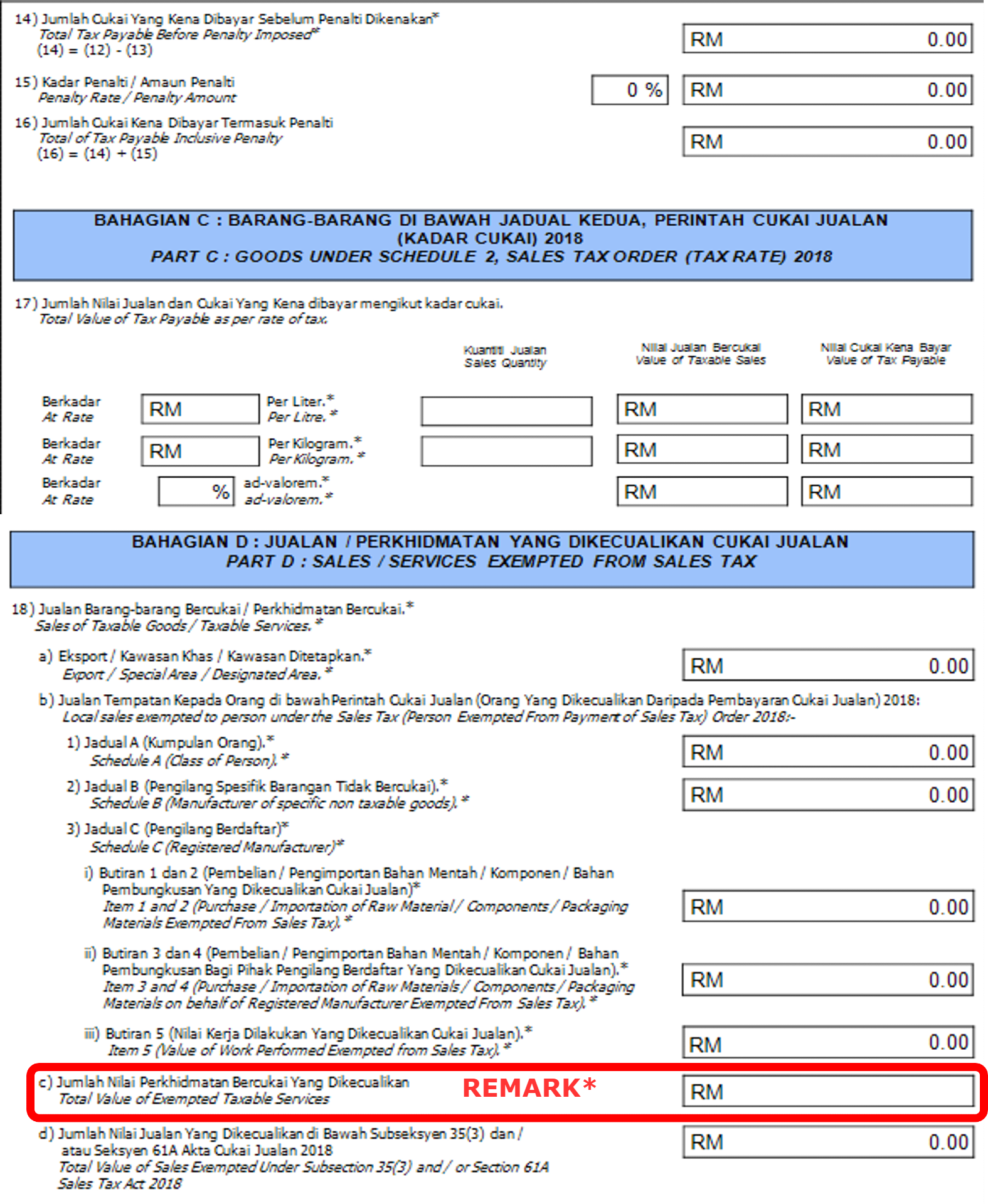

REMARK* – Section D: Item 18(c) Exempted Taxable Services

| Old Version | Listed as one line : “Value of Exempted Taxable Services” |

| New Version | Split into THREE separate categories:

|

| Example | A registered IT service provider charges another SST-registered company RM20, 000 for system maintennace (B2B exemption applies)

|

Section D – Item 18(d)

| Old Version | “Lain-lain Perkhidmatan Tidak Bercukai” / Other Non-Taxable Services |

| New Version | Replaced with “Total Value of Non-Taxable Services” |

| Example | Non-SST services like staff canteen income (not within taxable services list)

|