Chapter 6 – Creditor Maintenance

Chapter 6.4 – Goods Return

Goods Return is used when goods received from a supplier (for which a Goods Received Note has been created) are fully or partially returned before the Purchase Invoice is received. This entry will update the outstanding Goods Received Note (so that an accurate invoice can be issued later) and the stock level.

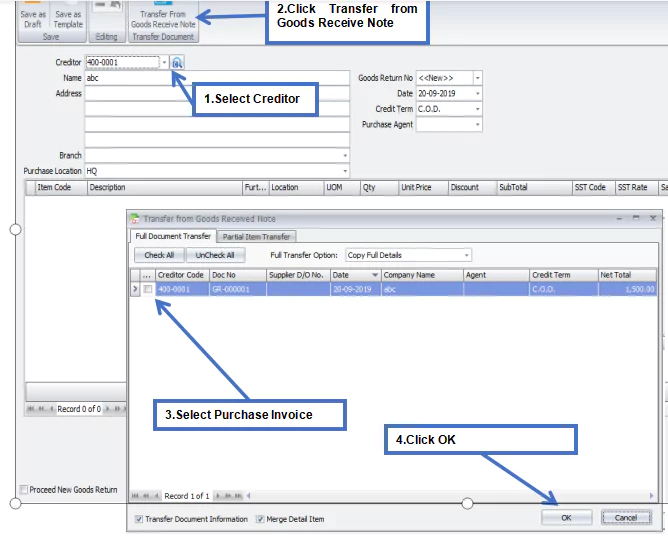

You must create a Goods Return from an existing Goods Received Note that has not yet been invoiced.

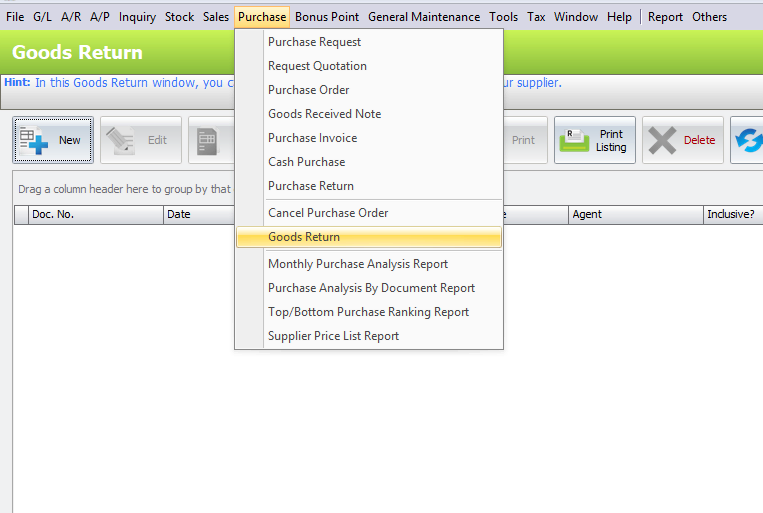

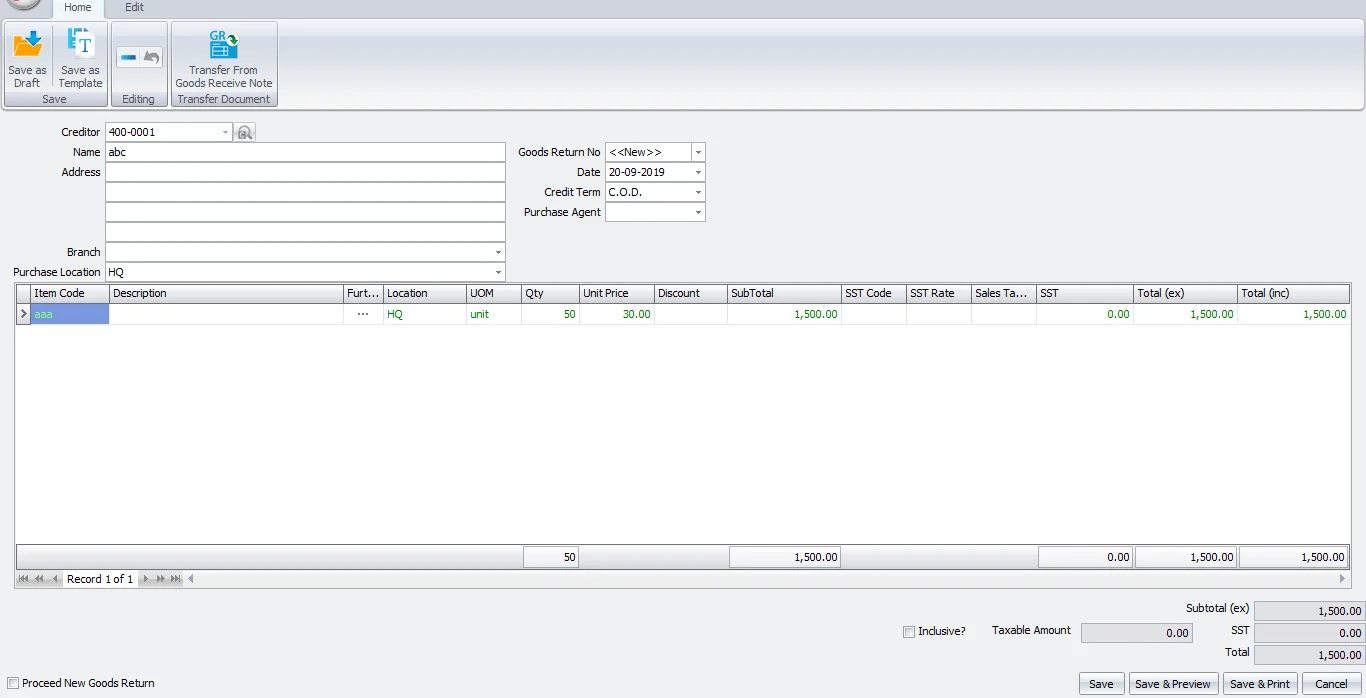

To create a Goods Return, go to Purchase > Goods Return > Click New to create a Goods Return.

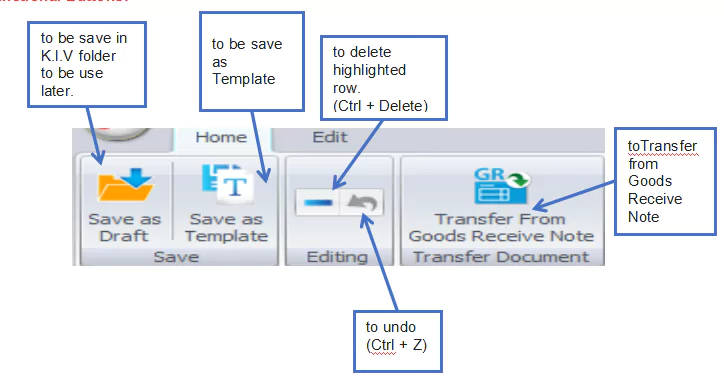

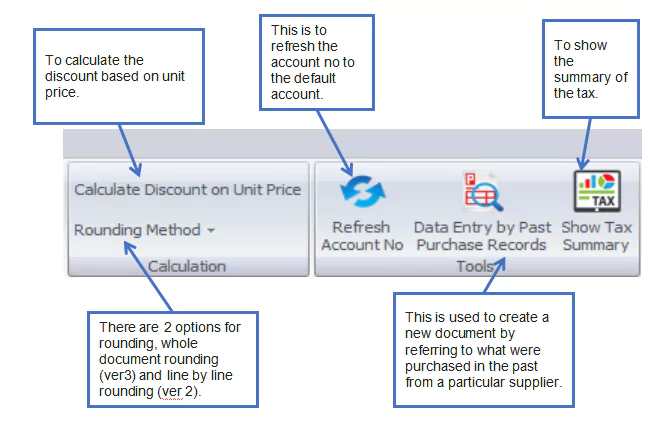

Functional Buttons

Header

Creditor: Select a creditor from Creditor Maintenance.

Address: Creditor Address.

Branch: Select the branch of the creditor (if any).

Goods Return No: <<New>> to use the auto-running numbering (maintained in Document Numbering Format Maintenance), but, you can enter a different number to change it. The next possible number is displayed at the top of the window.

Date: System date is captured automatically, but you can change it.

Credit Terms: The default credit terms will be displayed.

Purchase Agent: Assign a purchase agent, if needed. The default purchase agent can be assigned in creditor maintenance.

Details

Item Code: To add a new item, click the plus sign (+) and select an item. You can type the first few letters or numbers of the item code or description to search for it in the lookup screen.

Description: This is called the detailed description. It will automatically capture the item description, but you can edit it if needed.

Further Description: To view or edit the further description of this item, click the ‘…’ button. The default content can be maintained in Stock Item Maintenance.

UOM: The default unit of measurement will be captured.

Qty: Enter the quantity of the item.

Unit Price: The selling price will be captured from the standard selling price or the auto price setting.

Discount: Column discount allows you to enter a discount for any item in the detail row. The discount can be a value, percentage, or multi-level discount.

Subtotal: This is the line total (net).

SST Code/SST Rate/SST: These columns contains tax information from the Tax Configuration.

Total (ex): To show the subtotal before tax on the document.

Total (inc): To show the subtotal after tax on the document.

Subtotal (ex): To show the net total amount before tax on the document.