Chapter 6 – Creditor Maintenance

Chapter 6.5 – A/P Invoice

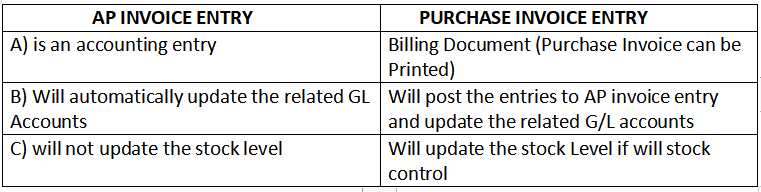

Differences between AP Invoice Entry and Purchase Invoice Entry

A/P Invoice Entry is different from Purchase Invoice, although both are used to record transactions with creditors.

A/P Invoice Entry is primarily used when you are not using invoicing system.

You are not allowed to edit an A/P Invoice Entry unless you check the checkbox for allowing editing of A/P Invoice Entries posted from other sources in the Options.

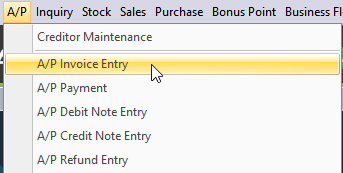

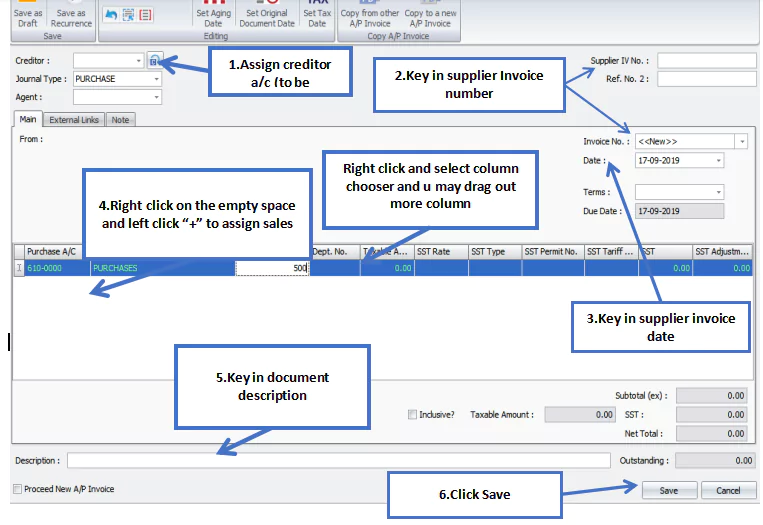

To create a A/P Invoice Entry, go to A/P > A/P Invoice Entry > Click New to create a Goods Return.

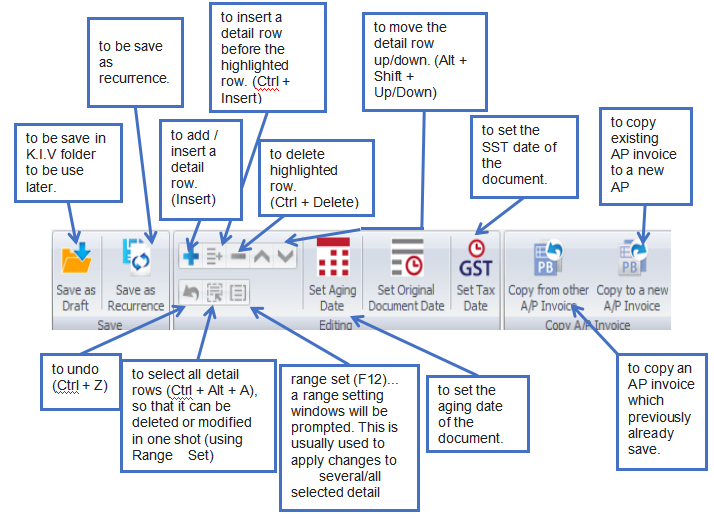

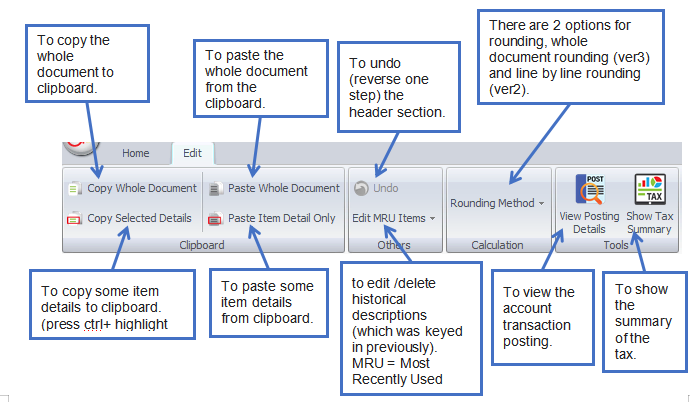

Functional Buttons

Header

Creditor: Select a creditor from Creditor Maintenance.

Journal Type: You may select the journal type if you have created more than one journal type associated with this Entry Type.

Agent: Assign a purchase agent, if any. The default Purchase Agent can be assigned in Creditor Maintenance.

Supplier IV No: Enter the supplier’s invoice number in this column.

Ref. No. 2: Enter another reference number if applicable.

Invoice No: <<New>> to use the auto-running numbering (maintained in Document Numbering Format Maintenance), but, you can enter a different number to change it. The next possible number is displayed at the top of the window.

Date: System date is captured automatically, but you can change it.

Terms: The default credit terms will be displayed.

Due Date: The value will be automatically calculated based on the date and terms.

Details

Puchase A/C: To add a new item, click the plus sign (+) and select an item. You can type the first few letters or numbers of the item code or description to search for it in the lookup screen.

Description: This is called the detailed description. It will automatically capture the account description, but you can edit it if needed.

Amount: Enter the invoice amount. (To show itemized amounts, add more rows).

SST Type/SST Rate/ SST Tariff Code/ SST/ SST Adjustment: These columns contains tax information from the Tax Configuration.

Footer

Subtotal (ex): To show the net total amount before tax on the document.

SST: To display the total SST based on the taxable amount.

Net Total: To show the net total after tax.

Description: This is called document description and will remember the most recently entered description.

Outstanding: The outstanding amount of this invoice. This value will change accordingly if payment or partial payment is made.

Proceed new A/P Invoice: If this checkbox is selected, a new screen will be ready for new entries after you save. Else, the transaction screen will close after you save.

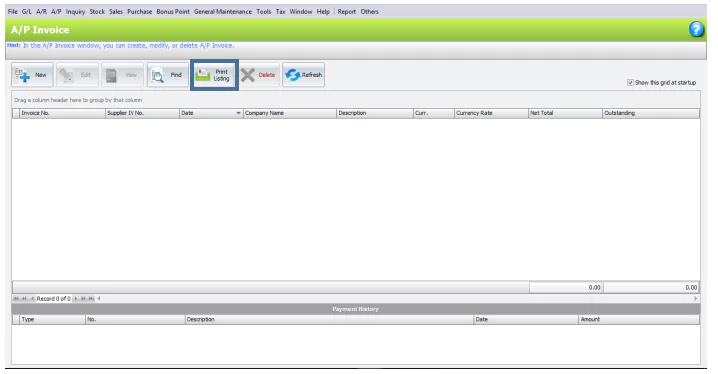

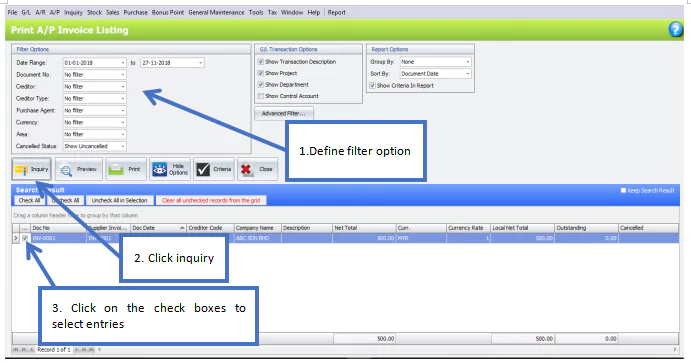

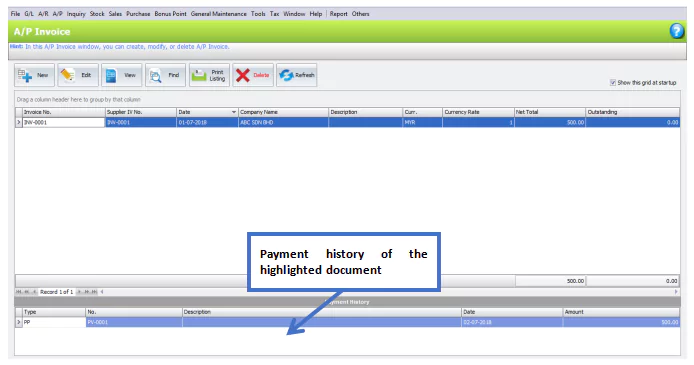

A/P Invoice Entry Listing

Yellow background documents indicate that they were posted from another source.

Red font documents indicate that they are past their due date.

Click Print Listing to preview listing report.