Chapter 8 Cash Book Entry

08.01 Cash Book Entry

This is used to record cash transaction entries. E.g. cash receipts and cash payments.

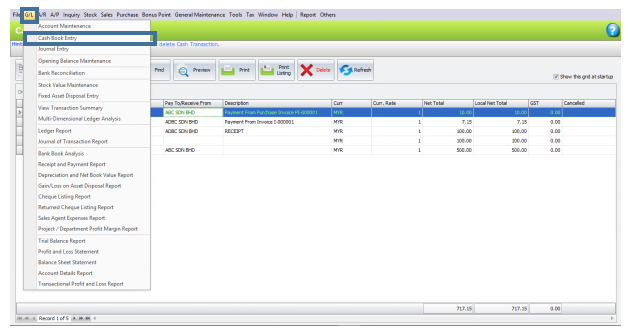

Go to G/L > Cash Book Entry

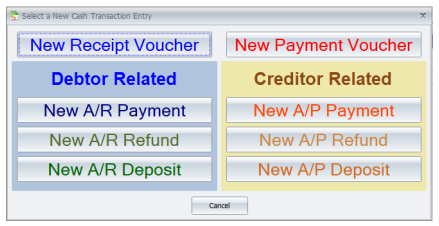

Click on Create A New Cash Transaction

Select document type to be created

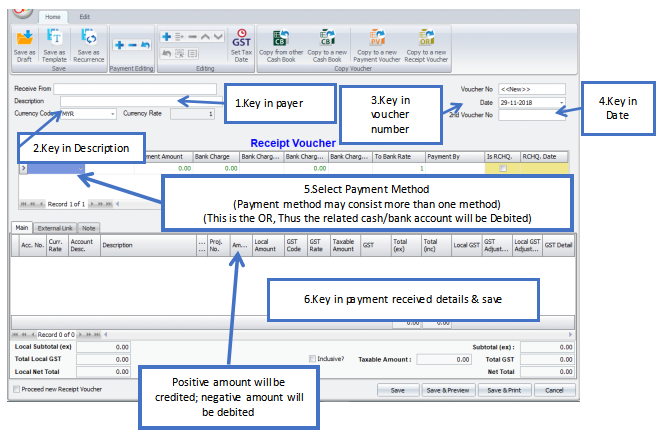

08.02 Receipt Voucher

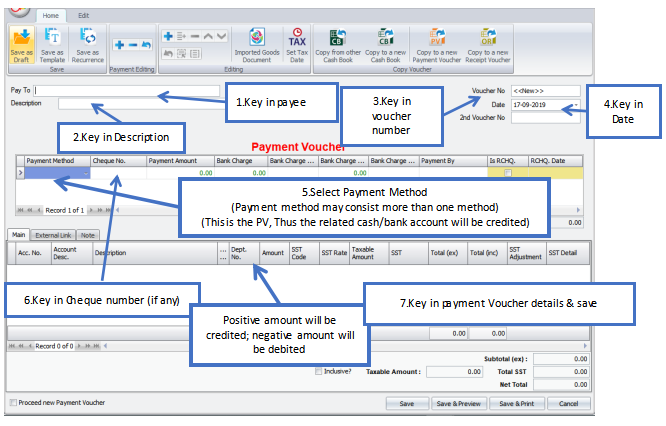

08.03 Payment Voucher

Payment Method: select the payment method; the cash/bank account this payment method belonged to will be Credited. Sometimes it may involve more than one payment methods.

Cheque No: key in cheque number if any.

Payment Amount: the amount of payment made with this payment method.

Bank Charge: key in bank charge value if any.

Bank Charge Tax Code: to maintain bank charges tax code

Bank Charge Tax: the amount of SST for bank charges

Payment By: key in the mode of payment.

Is RCHQ: this used when a cheque payment made earlier is returned/bounced (use Edit mode).

RCHQ Date: define the date when the cheque is returned/bounced.

Acc. No.: select the related G/L accounts; you may key in the first few number/letters of the account number/description and select from the lookup screen. Click on ‘+’ sign to add a new row.

Account Desc.: the description of the G/L account (auto-displayed upon selection of Acc. No.).

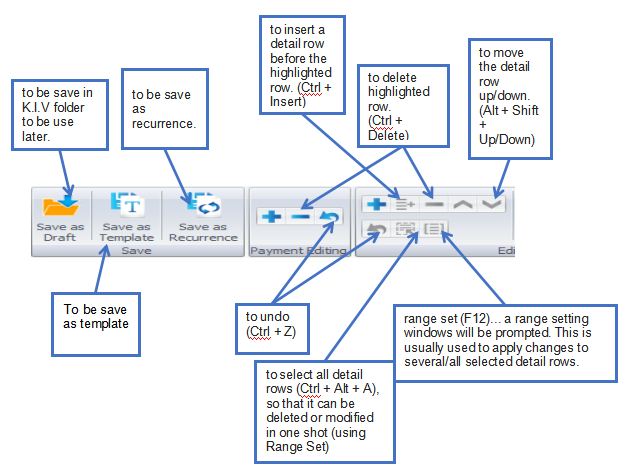

Description: the description of this entry. One fast way to fill in the same details for several rows is to use the button of Select All Details (Ctrl + Alt + A), then click on the button of Range Set (F12) to set the description and apply.

Amount: since this is a payment, any positive amount here will be debited, and negative amount will be Credited.

SST Code: to show the SST code.

SST Rate: to show the rate of SST

SST: to show the amount of SST.

Total (ex): to show the subtotal before tax.

Total (inc): to show the subtotal after tax.

Proceed new Payment Voucher: when this is checked, a fresh screen will be ready for new entries upon Save; if unchecked will exit the transaction screen.

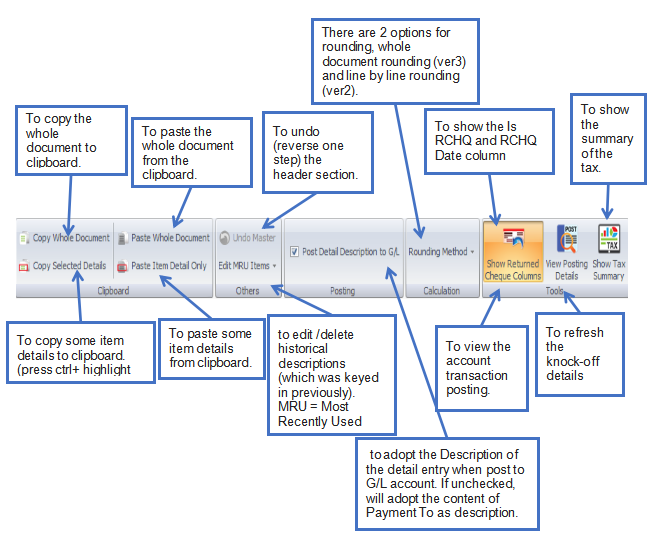

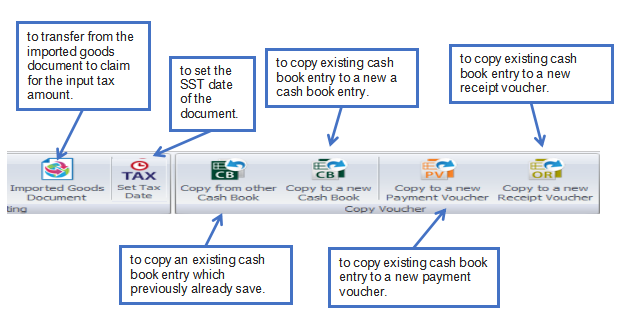

Functional Buttons:

Edit Button: