Chapter 4 Opening Balance Maintenance

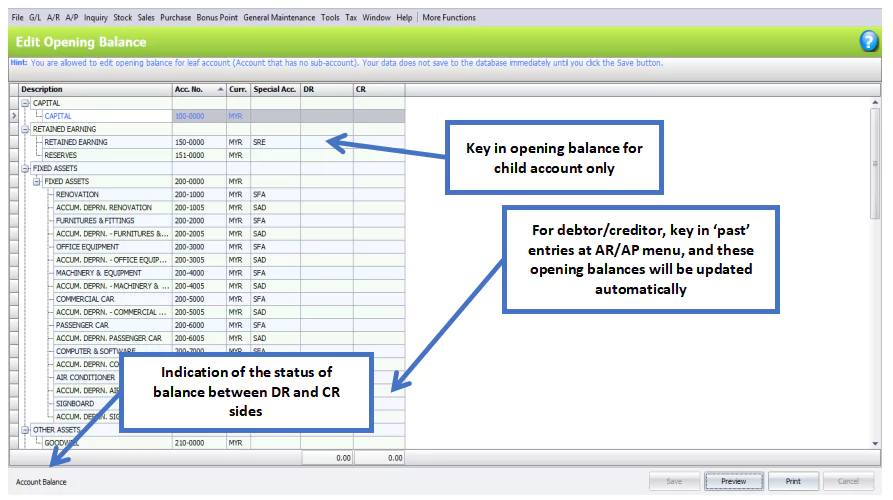

04.01 Opening Balance Maintenance

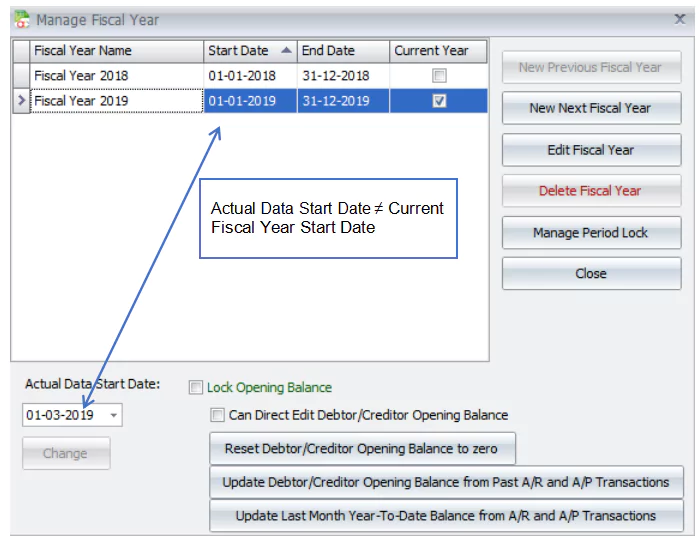

This is used to key in opening balances of current fiscal year when Actual Data Start Date is the same as Start Date of current Fiscal Year.

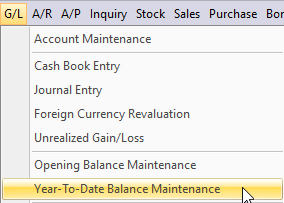

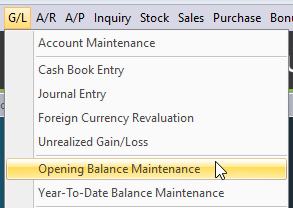

Go to G/L > Opening Balance Maintenance

- Key in balance amount only in child accounts (which carry no further sub-accounts); the total amount will be auto-filled into their parent account.

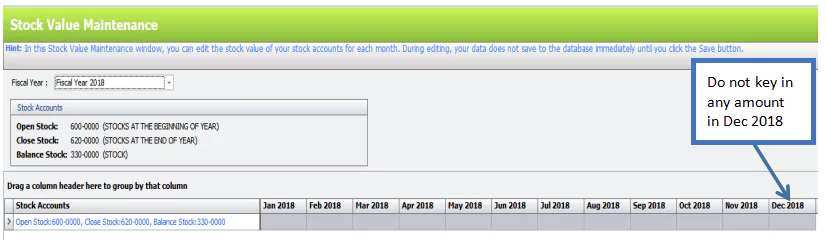

- The value of Balance Sheet Stock keyed in here will update the value of closing stock (the last month of the year prior to current fiscal year) at G/L > Stock Value Maintenance (of course with the condition of: the previous fiscal year was added in Manage Fiscal Year). Be aware that if you change that value of closing stock of the last month of the year prior to current fiscal year, the changes made in Stock Value Maintenance will not update the value in Opening Balance Maintenance.

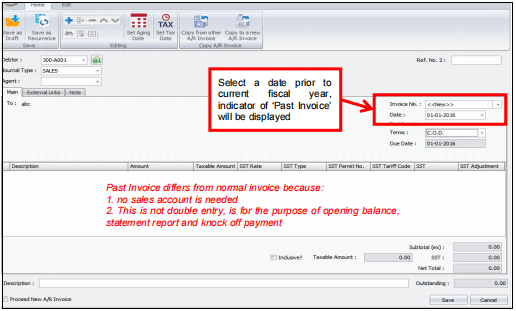

- It is advisable not to key in opening balances of personal account (debtor/creditor) here directly, instead, add ‘past entries’ at AR/AP menu and the debtor/creditor opening balances will be updated automatically.

- To allow directly key in opening balance for debtors/creditors, go to Tools > Manage Fiscal Year, highlight current fiscal year, check the checkbox of.

- It is not advisable to key in debtor/creditor opening balance in this way because it keeps no record of entries, thus will not be shown in debtor statement and knock off payment is not available.

- Go to AR/AP menu to key in ‘Past’ entries or ‘YTD’ entries such as Invoice, CN, DN, Payment…. If you do not wish to key in all the outstanding bills one by one, you may just add one Past or YTD invoice with the total (one lump sum) outstanding balance. The amounts of Past/YTD entries will be updated to Opening/YTD Balance; if not, go to Tools > Manage Fiscal Year, highlight the current fiscal year, click on

OR

Past entries means A/R or A/P entries (usually Invoice, but also including Payment, DN, CN…) that is created with a date prior to current fiscal year.

For example: A/R Invoice

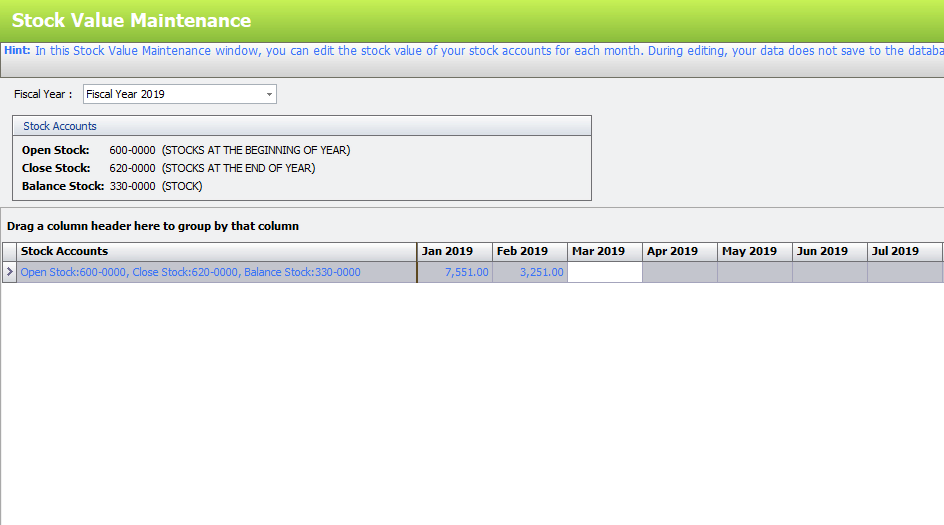

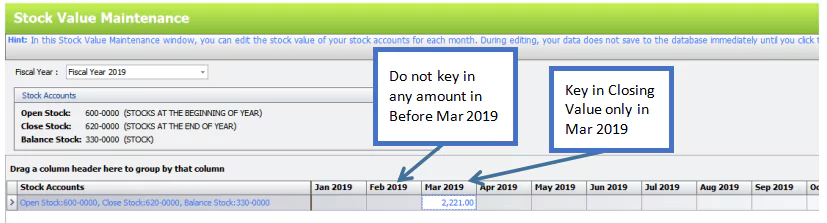

04.02 Enter Opening Balance in Stock Value Maintenance

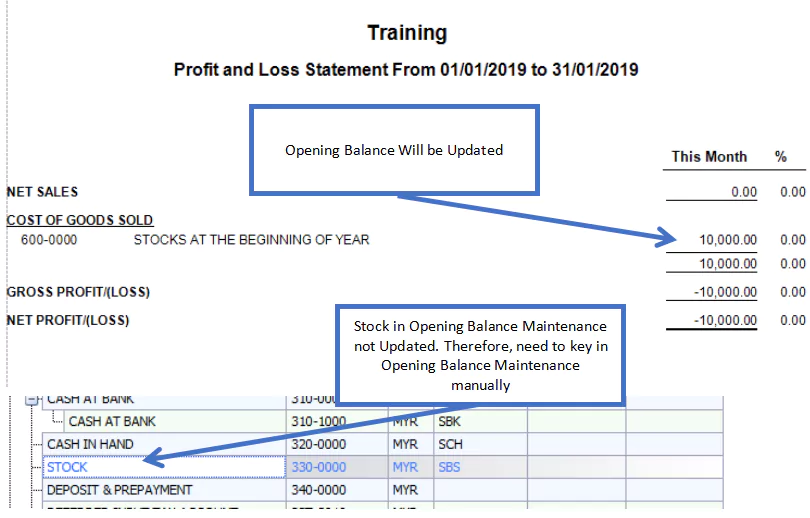

Enter Stock Value Opening Balance (Closing Stock as at 31st Dec 2014) in Opening Balance Maintenance and Stock Value Maintenance

04.03 MTD Balance Maintenance

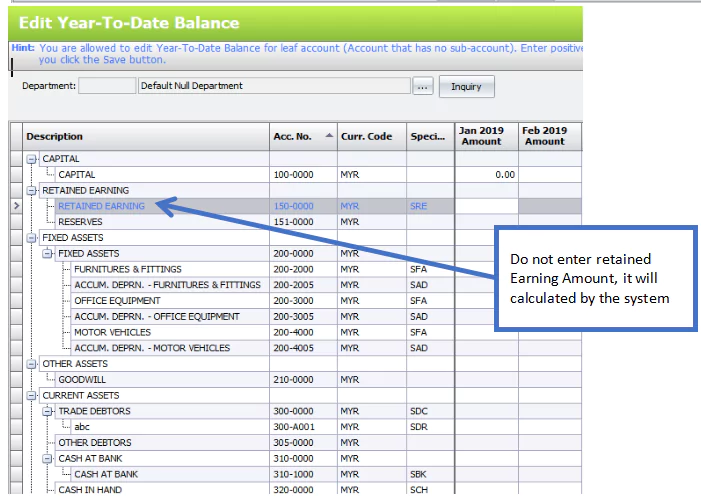

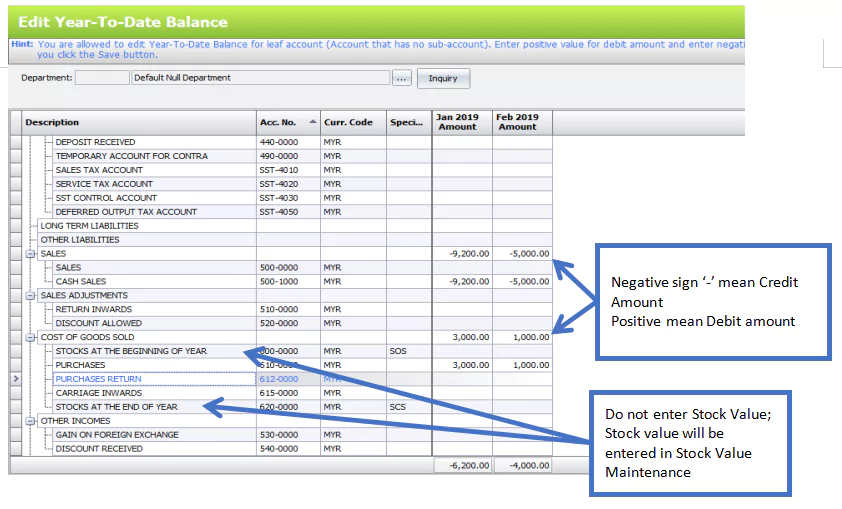

If Actual Data Start Date (01-01-2019) ≠ current Fiscal Year Start Date (01-03-2019) MTD balance for Jan ~ Feb will be keyed in month by month.

a. do not enter Stock value; stock value will be entered in Stock Value Maintenance.

b. do not enter value for Retained Earning; it will be calculated by the system.

c. basically, negative sign ‘-‘ means credit balance, positive means debit balance.

Note: For account types that are Credit in nature (such as Liability, Sales, Income, Capital, Accumulated Depreciation, Purchase Return ..), MTD balance with negative sign ‘-‘ will increase YTD balance. Thus a positive MTD balance will reduce YTD balance.

for account types that are Debit in nature (such as Asset, Expenses, Purchases, Sales Return..), MTD balance with negative sign ‘-‘ will reduce YTD balance. Thus a positive MTD

balance will increase YTD balance.

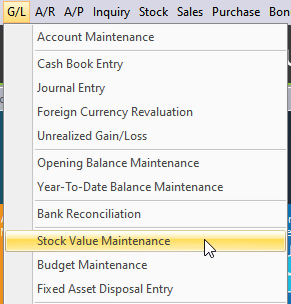

2) Go to GL> Stock Value Maintenance to key in Monthly Closing Stock

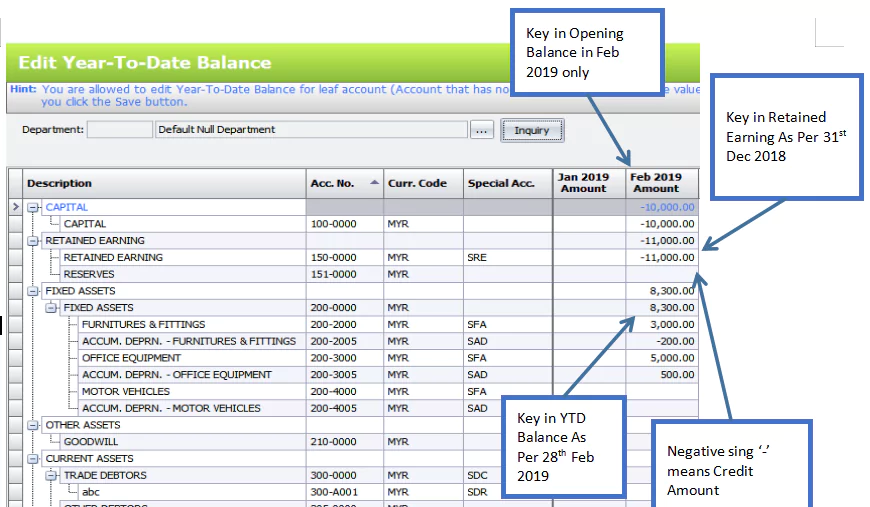

04.04 YTD Balance Maintenance

If Actual Data Start Date (01-01-2019) ≠ current Fiscal Year Start Date (01-03-2019) The total balance will be keyed in month Feb 2019 as YTD Balance

Observe the following tips:

A) enter balance amount just as your Profit & Loss and Balance Sheet as at Feb 2019,including Stock value, except Retained Earning

B) for Retained Earning, enter the value as at beginning of current fiscal year, current year Retained Earning (YTD) will be calculated by the system.

C) basically, negative sign ‘-‘ means credit balance, positive means debit balance

2) Go to G/L>Stock Value Maintenance