Chapter 7 Debtor Maintenance

07.01 Debtor Maintenance

This is to maintain debtor account.

Go to A/R > Debtor Maintenance

Debtor listing will be displayed.

Group Company: if this is checked, it means this debtor account is the control account of a group company; this debtor account will be allowed to be chosen as control account (appear as one of control accounts in Control Account field of this screen) for other debtors. This account will not carry any transaction/entries (just like Debtor Control account), and it functions just like a parent account.

Example: 300/0000 Debtor Control Account

300/GABB General Trading Berhad (marked as Group Company, control account is 300/0000)

300/GAB1 General Marketing S/B (control account is 300/GABB)

300/GAB2 General Production S/B (control account is 300/GABB)

300/N00A Normal debtor account A (not marked as Group Company, control account is 300/0000)

300/N00B Normal debtor account B (not marked as Group Company, control account is 300/0000)

Invoices will be billed to sub-accounts respectively, you may view statement of separate sub-accounts and the Group account (look into More Options); the Group account will appear as parent account in Balance Sheet.

Group company is not the same as branch maintenance (which only shows different delivery addresses).

Contact tab

Branches tab

You may choose the branch during transaction that involves branch delivery address (e.g. Delivery Order > More Header tab)

Tax Exemption Tab

Others tab

Note tab

Note keyed in here can be copied to transaction document that involves this debtor. (refer to Tools > Option > Invoicing > Document Transfer > Copy Debtor Note to Sales Document Note)

07.02 Sales Invoice

i. Sales invoice is for create, edit or print Invoice

ii. Sales invoice will affect inventory movement (decrease Stock Level) if

A) New Added-Key in bu using Sales invoice (without transfer from other document)

B) Transfer from Quotation

C) Transfer from Sales Order

iii. Sales invoice will Not affect inventory movement (decrease Stock Level) if

A) Transfer from Delivery Order (Stock Level decrease while created and saved Delivery Order)

B) Sales Invoice will posted to A/R Invoice Entry upon Save

Go to Sales >Invoice

Debtor: will be displayed automatically (as per transferred document)

Branch: specify the branch of this debtor (if any)

Address: the info will be displayed according to selected debtor code.

Invoice No: <<New>> means to follow auto-running numbering (maintained at Document Numbering Format Maintenance), and the next possible number is displayed at the top bar of the window. You may click on it to key in any number you like.

Date: system date is automatically captured, you may click to change.

Branch: specify the branch of this debtor (if any)

Sales Agent: assign a sales agent (if any). The default Sales Agent can be assigned in Debtor Maintenance.

Ship Via: assign the shipping method (maintained at Shipping Method Maintenance)

Credit Terms: the default credit terms of this debtor will be displayed.

Shipping Info: key in the info of shipping or transportation.

Details Column

Item Code: click on ‘+’ sign to add a new row and select an item; you may key in the first few number/letters of the item code/description and select from the lookup screen.

Description: this is called detail description… will capture the item description automatically (amendable)

Further Description: click to view/edit Further Description of this item. (the default content can be maintained at Stock Item Maintenance)

Delivery Date: assign the expected delivery date (if needed)

UOM: the default unit of measurement will be captured;

Qty: key in the quantity.

Unit Price: the selling price will be captured (either Standard Selling Price or according to the setting in Tools > Options > Invoicing > Auto Price)

Discount: this is called column discount; you may key in the discount for any particular detail row. The discount could be a value (e.g. 5, 5.5, 10… ), a percentage (e.g. 5%, 5.5%, 10%), or a multi-level discount (e.g. 5+5.5, 5+5%, 5%+5%, 10%+5, 5%+5%+10, …. )

Total: this is the line total (net)

SST Code: to show the SST code.

SST Rate: to show the rate of SST

SST: to show the amount of SST.

Total (ex): to show the subtotal before tax.

Total (inc): to show the subtotal after tax.

Subtotal (ex): to show the net total amount before tax.

Proceed new invoice: when this is checked, a fresh screen will be ready for new document upon Save; if unchecked will exit the transaction screen upon Save.

Functional Buttons:

Edit tab:

Print invoice

07.03 A/R Invoice Entry

This is to create, edit or view A/R Invoice Entry.

A/R Invoice Entry is different from Sales Invoice though they are both involving debtors:

- A/R Invoice Entry is an Accounting entry (no bill printing); while Sales Invoice is a billing document (Invoice can be printed)

- A/R Invoice Entry (upon save) will automatically update the related G/L accounts; Sales Invoice (upon save) will post automatically (depends on option setting) the entries to A/R Invoice Entry and update the related G/L accounts.

- A/R Invoice Entry is mainly used when you are not using Invoicing system;

- You are not allowed to edit A/R Invoice Entry if it was posted from other source (Sales Invoice).

To Create New A/R Invoice Entry

Go to A/R > A/R Invoice Entry

Click on Create A New A/R Invoice

Debtor: key in the first number/alphabet, OR click on the drop down arrow button, OR click on Search button to assign/select a debtor number.

Journal Type: you may select the journal type if you have maintained more than one journal type belonged to this Entry Type (refer to Journal Type Maintenance)

Agent: assign a sales agent (if any). The default Sales Agent can be assigned in Debtor Maintenance.

Ref. No.2: key in other reference number if any.

Invoice No: <<New>> means to follow auto-running numbering (maintained at Document Numbering Format Maintenance), and the next possible number is displayed at the top bar of the window. You may click on it to key in any number you like.

Date: system date is automatically captured, you may click to change.

Terms: credit terms of this debtor.

Due Date: auto-calculated according to Date and Terms.

Details Column

Sales A/C: click on ‘+’ sign to add a new row and select the account number; you may key in the first few number/letters of the account number/description and select from the lookup screen.

Description: this is called detail description… will capture the account description automatically (amendable)

Amount: key in the invoice amount. (add several rows if you want to show itemised amounts.)

SST Type: to show the SST code.

SST Rate: to show the rate of SST.

SST Permit No: to use in Singapore only.

SST Tariff Code: Item Tariff Code Maintained at Tax>Tariff Maintenance

SST: to show the amount of SST.

SST Adjustment: to adjust the SST amount.

Subtotal (ex): to show the net total amount before tax.

SST: to show the total SST based on taxable amount.

Net Total: to show the net total after tax.

Description: this is called document description…will remember from most recently keyed in description.

Outstanding: the outstanding amount of this Invoice. This value will change accordingly if payment/partial payment is made.

Proceed with new A/R Invoice: when this is checked, a fresh screen will be ready for new entries upon Save; if unchecked will exit the transaction screen upon Save.

Functional Buttons:

Edit:

Yellow background Document indicate that the document is posted from other source

Red colour font document indicate that the document is overdue

4. Click Preview and Select Report

07.04 Credit Note

This is to create, edit or print sales credit note.

Sales Credit Note is used when there was a goods return (involved physical stock movement) or change in item price, other wise (if it involves only a chang in total amount use A/R Credit Note Instead

To Create New Credit Note

Go to Sales> Credit Note

Debtor: key in the first number/alphabet/keywords, OR click on the drop down arrow button, OR click on Search button to assign/select a debtor number.

To/Address: the info will be displayed according to selected debtor code.

Reason: The reason of why credit note is being issued.

C/N No: <<New>> means to follow auto-running numbering (maintained at Document Numbering Format Maintenance), and the next possible number is displayed at the top bar of the window. You may click on it to key in any number you like.

Date: system date is automatically captured, you may click to change.

Branch: specify the branch of this debtor (if any).

Sales Agent: assign a sales agent (if any). The default Sales Agent can be assigned in Debtor Maintenance.

C/N Type: select the credit note type (maintained at C/N Type Maintenance)

Credit Terms: the default credit terms of this debtor will be displayed.

Our Invoice No: the related invoice number will be filled automatically.

Functional Buttons:

Functional Buttons:

Details Column

Item Code: click on ‘+’ sign to add a new row and select an item; you may key in the first few number/letters of the item code/description and select from the lookup screen.

Description: this is called detail description… will capture the item description automatically (amendable)

Further Description: click to view/edit Further Description of this item. (the default content can be maintained at Stock Item Maintenance)

UOM: the default unit of measurement will be captured;

Qty: key in the quantity.

Unit Price: the selling price will be captured (either Standard Selling Price or according to the setting in Tools > Options > Invoicing > Auto Price)

Discount: this is called column discount; you may key in the discount for any particular detail row. The discount could be a value (e.g. 5, 5.5, 10… ), a percentage (e.g. 5%, 5.5%, 10%), or a multi-level discount (e.g. 5+5.5, 5+5%, 5%+5%, 10%+5, 5%+5%+10, …. )

SubTotal: this is the line total (net)

SST Code: to show the SST code.

SST Rate: to show the rate of SST

SST: to show the amount of SST.

Total (ex): to show the subtotal before tax.

Total (inc): to show the subtotal after tax.

Subtotal (ex): to show the net total amount before tax.

Proceed new C/N: when this is checked, a fresh screen will be ready for new document upon Save; if unchecked will exit the transaction screen upon Save.

Print Credit Note Listing

4. Click Print & Select Report format

07.05 A/R Credit Note

This is to create, edit, or view A/R Credit Note Entry. A/R Credit Note Entry is also use to knock-off A/R Invoice and/or A/R Debit Note.

A/R Credit Note Entry is different from Sales Credit Note though they are both involving debtors:

- A/R Credit Note Entry (upon save) will automatically update the related G/L accounts; Sale Credit Note (upon save) will post automatically (depends on option setting) the entries to A/R Credit Note Entry and update the related G/L accounts.

- You are not allowed to edit A/R Credit Note Entry if it was posted from other source (Sales Credit Note).

Credit Note is also used when debtor A’s debt is to paid by B, in this case a CN will be created for A and a DN for B.

To Create New A/R Credit Note Entry

Go to A/R > A/R Credit Note Entry

Click on Create A New A/R Credit Note

Debtor: key in the first number/alphabet, OR click on the drop down arrow button, OR click on Search button to assign/select a debtor number.

Journal Type: you may select the journal type if you have maintained more than one journal type belonged to this Entry Type (refer to Journal Type Maintenance)

CN Type: select the Credit Note type. Credit Note Type is maintained at C/N Type Maintenance.

Ref.: key in the reference number, e.g. Invoice No.

Ref. No.2: key in other reference number if any.

Description: this is called document description…will remember from most recently keyed in description.

Reason: the reason of credit note being issued.

CN No: <<New>> means to follow auto-running numbering (maintained at Document Numbering Format Maintenance), and the next possible number is displayed at the top bar of the window. You may click on it to key in any number you like.

Date: system date is automatically captured, you may click to change.

Our Invoice No: to key in debtor invoice no or for your own reference.

Debit A/C: right click on ‘+’ sign to add a new row and select the account number; you may key in the first few number/letters of the account number/description and select from the lookup screen.

Description: this is called detail description… will capture the account description automatically (amendable)

Amount: key in the credit note amount. (add several rows if you want to show itemised amounts.)

SST Type: to show the SST code.

SST Rate: to show the rate of SST.

SST: to show the amount of SST.

SST Adjustment: to adjust the SST amount.

Subtotal (ex): to show the net total amount before tax.

SST: to show the total SST based on taxable amount.

Net Total: indicates the total credit note amount of this entry.

Unapplied Amount: to show the credit note amount that has yet to knock off against Invoice/Debit Note. If there is any note been saved with unapplied amount, message will be prompted when adding new Credit Note Entry offering to open and use the previous unapplied amount.

Knock Off Invoices/Debit Note section

Type: indicates the type of transaction; e.g. RI (A/R Invoice), RD (A/R Debit Note)…

Date: indicates date of Invoice or DN.

No.: indicates document number

Org. Amt.: indicates the original amount of the document before any knock off

Outstanding: indicates the amount of the document that yet to pay.

Pay: the knock off amount. Click on this column header to automatically fill in the knock off amount.

Knock Off Date: the date when the document being pay or knock off (the date must be equal or greater the document date)

Proceed New A/R Credit Note: when this is checked, a fresh screen will be ready for new entries upon Save; if unchecked will exit the transaction screen upon Save

Print A/R Credit Note Listing

5.Click Print & Select Report format

07.06 Payment for Sales Invoice

07.07 A/R Receive Payment

This is to record full/partial payment received from debtor, knock-off related invoice or Debit Note, and print Official Receipt

Go to A/R > A/R Receive Payment

Debtor: key in the first number/alphabet, OR click on the drop down arrow button, OR click on Search button to assign/select a debtor number.

Payment’s Currency: to make payment in different currency.

Description: this is called document description…will remember from most recently keyed in description.

Official Receipt No: <<New>> means to follow auto-running numbering (maintained at Document Numbering Format Maintenance), and the next possible number is displayed at the top bar of the window. You may click on it to key in any number you like.

Date: system date is automatically captured, you may click to change.

2nd Receipt No: The DocNo2 column will be posted to Cash Book Entry’s 2nd Voucher No. (for your own reference)

Details Column

Payment Method: select a payment method. Click on ‘+’ sign to add a new row for multiple payment method.

Cheque No.: key in cheque number if any.

Payment Amount: key in the payment amount by this payment method.

Bank Charge: key in bank charge value if any.

Bank Charge Tax Code: to maintain bank charges tax code

Bank Charge Tax: the amount of SST for bank charges

Payment By: key in the mode of payment.

Is RCHQ: this used when a cheque payment made earlier is returned/bounced (use Edit mode).

RCHQ Date: define the date when the cheque is returned/bounced.

Amount: indicates the total payment amount of this entry.

Unapplied Amount: to show the payment amount that has yet to knock off against Invoice/Debit Note. If there is any payment been saved with unapplied amount, message will be prompted when adding new Receive Payment offering to open and use the previous unapplied amount.

Knock Off Invoices/Debit Note section

Type: indicates the type of transaction; e.g. RI (A/R Invoice), RD (A/R Debit Note)…

Date: indicates date of Invoice or DN.

No.: indicates document number

Org.Amt.: indicates the original amount of the document before any knock off

Outstanding: indicates the amount of the document that yet to pay.

Discount Due: indicates the due date for early payment discount (refer to Credit Term Maintenance)

With Disc.: to indicate the document is entitled for discount; check to key in discount amount; CN will be generated.

Disc. Amt.: to key in the discount amount (or auto-calculated based on early payment discount); the Outstanding amount will reduce accordingly.

Pay: the knock off amount. Click on this column header to automatically fill in the knock off amount.

Knock Off Date: the date when the document being pay or knock off (the date must be equal or greater the document date)

Proceed New Receive Payment: when this is checked, a fresh screen will be ready for new entries upon Save; if unchecked will exit the transaction screen upon Save

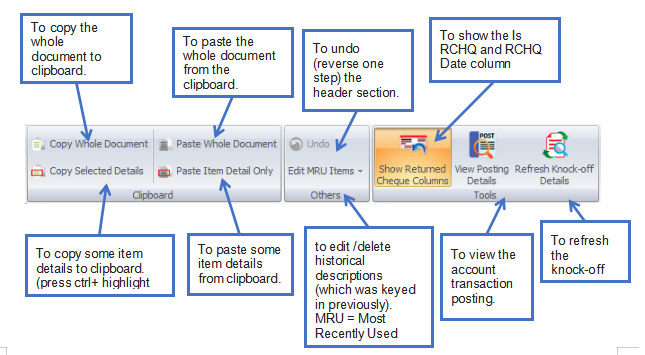

Functional Buttons:

Edit Button:

6. Click Print & Select Report format