Chapter 6 – Creditor Maintenance

Chapter 6.3 – Purchase Return

Purchase Return should be used when there is a goods return (requiring physical stock movement) or a change in item price. Otherwise, if the change only affects the total amount, use an A/P Credit Note instead.

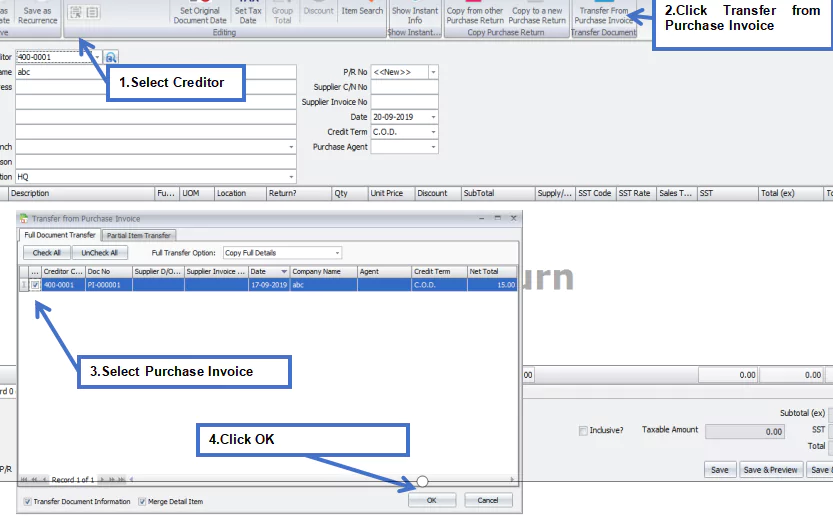

Purchase Return must transfer from an existing Purchase Invoice.

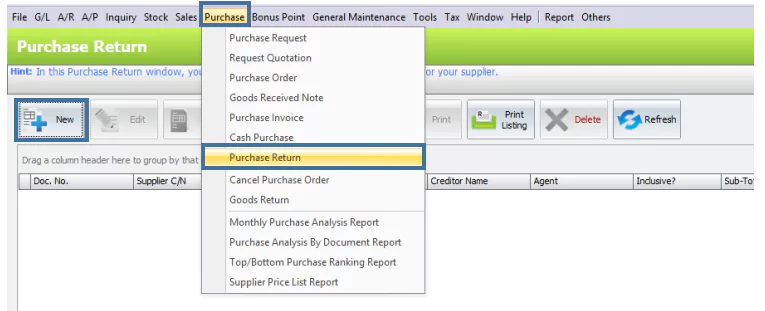

To create a Purchase Return, go to Purchase > Purchase Return > Click New to create a Purchase Return.

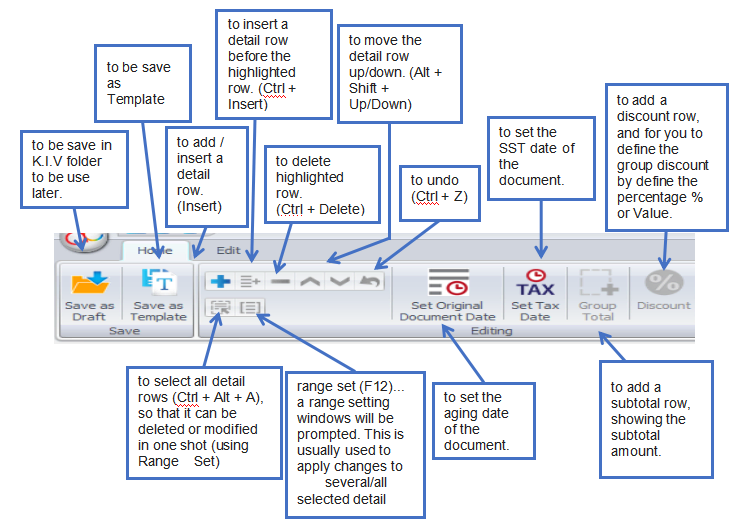

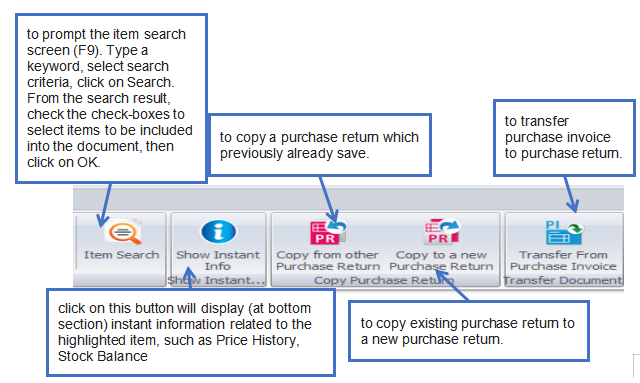

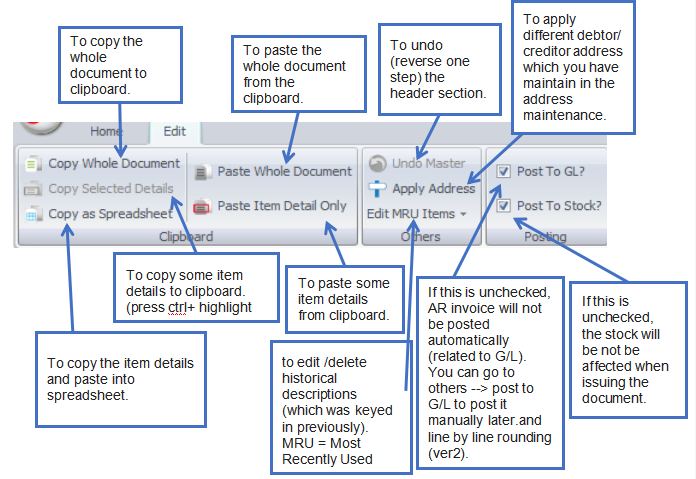

Functional Buttons

Header

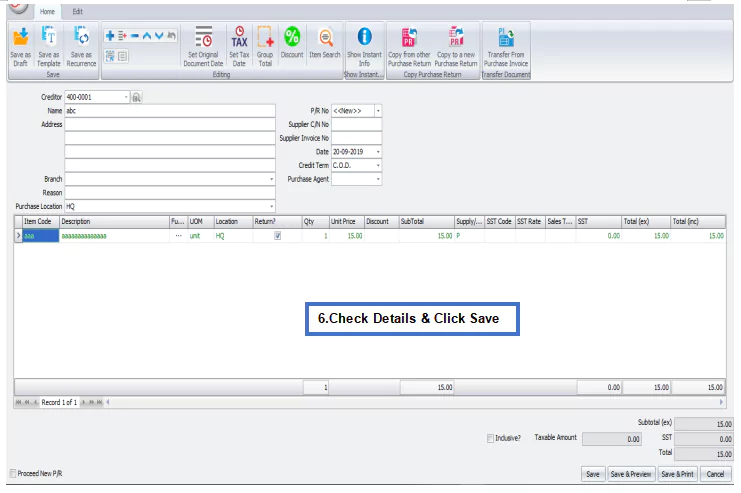

Creditor: Select a creditor from Creditor Maintenance.

Address: Creditor Address.

Branch: Select the branch of the creditor (if any).

P/R No:<<New>> to use the auto-running numbering (maintained in Document Numbering Format Maintenance), but, you can enter a different number to change it. The next possible number is displayed at the top of the window.

Supplier C/N No.: Enter the supplier’s C/N number.

Supplier Invoice No.: Enter the supplier invoice number.

Date: System date is captured automatically, but you can change it.

Credit Terms: The default credit terms will be displayed.

Purchase Agent: Assign a purchase agent, if needed. The default purchase agent can be assigned in creditor maintenance.

Details

Item Code: To add a new item, click the plus sign (+) and select an item. You can type the first few letters or numbers of the item code or description to search for it in the lookup screen.

Description: This is called the detailed description. It will automatically capture the item description, but you can edit it if needed.

Further Description:To view or edit the further description of this item, click the ‘…’ button. The default content can be maintained in Stock Item Maintenance.

UOM: The default unit of measurement will be captured.

Qty: Enter the quantity of the item.

Unit Price: The selling price will be captured from the standard selling price or the auto price setting.

Discount: Column discount allows you to enter a discount for any item in the detail row. The discount can be a value, percentage, or multi-level discount.

Subtotal: This is the line total (net).

SST Code/SST Rate/SST: These columns contains tax information from the Tax Configuration.

Total (ex):To show the subtotal before tax on the document.

Total (inc):To show the subtotal after tax on the document.

Subtotal (ex):To show the net total amount before tax on the document.

Proceed new invoice: If this is checked, a fresh screen will be ready for a new document when you save. Else, the transaction screen will exit when you save.