Chapter 7 – Debtor Maintenance

Chapter 7.5 – A/R Credit Note

A/R Credit Note Entry is used to knock-offA/R Invoice or A/R Debit Note.

A/R Credit Note Entry and Sales Credit Note are different, although both involve debtors.

- Upon save, A/R Credit Note Entry automatically updates the related G/L accounts, while Sales Credit Note post entries to A/R Credit Note Entry and update the related G/L accounts, depending on the option setting.

If debtor B pays debtor A’s debt, a credit note will be issued to A and a debit note to B.

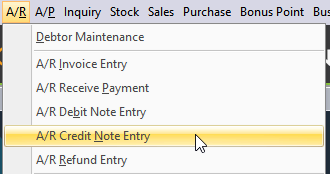

To create the new a/r credit note, click A/R > A/R Credit Note Entry.

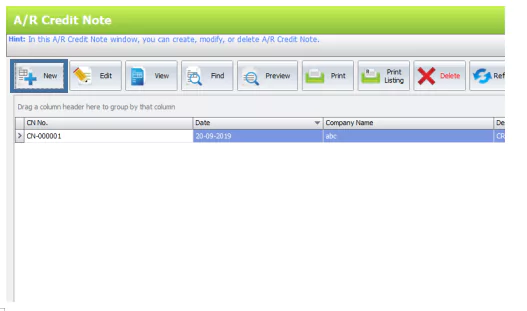

Click New to create new a/r credit note.

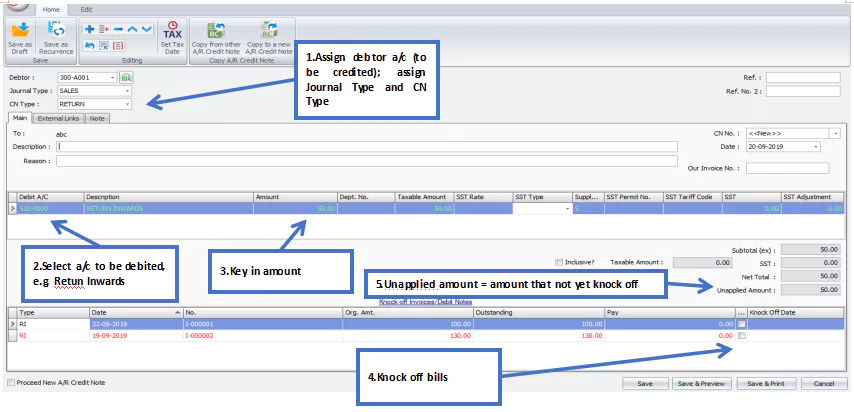

Header

Debtor:Select a debtor from Debtor Maintenance.

Journal Type:You may select the journal type if you have maintained more than one journal type belonging to this Entry Type. For more information, see Journal Type Maintenance

Ref.: Select the Credit Note Type. Credit Note Type is maintained at C/N Type Maintenance.

Ref. No. 2: Enter an additional reference number if applicable.

Details

Description: This is called document description. It will remember the most recently keyed-in description.

Reason: The reason for the credit note being issued.

CN No:<<New>> to use the auto-running numbering (maintained in Document Numbering Format Maintenance), but, you can enter a different number to change it. The next possible number is displayed at the top of the window.

Date:System date is captured automatically, but you can change it.

Our Invoice No:Enter the debtor’s invoice number as a reference for your records.

Debit A/C:To add a new item, click the plus sign (+) and select an item. You can type the first few letters of item code or description to search for it in the lookup screen.

Description: This is called a detailed description. It will capture the account description automatically and can be amended.

Amount:Enter the credit note amount. Add multiple rows if you want to show itemized amounts.

SST Type/ SST Rate/ SST/ SST Adjustment: Use these columns, to apply tax to the line items on your credit note.

Net Total: This indicates the total credit note amount for this entry.

Unapplied Amount: To show the credit note amount that has yet to be offset against an invoice or debit note. If there is any saved note with an unapplied amount, a message will be prompted upon adding a new credit note entry offering to open and use the previous unapplied amount.

Knock Off Invoices/ Debit Note

Type: Indicates the type of transaction. Example,RI (A/R Invoice) & RD (A/R Debit Note).

Date: Indicates date of document.

No: Indicates document number.

Org. Amt.:Indicates the original amount of the document (before any knock-off).

Outstanding:Indicates the amount of the document that remains to be paid.

Pay: The knock off amount. Click on this column header to automatically calculate the knock-off amount.

Knock Off Date:The date when the document is paid or knocked off (the date must be equal to or greater than the document date).

Proceed New A/R Credit Note:If this box is checked, a new screen will be opened for new entries after saving. If unchecked, the transaction screen will close after saving.

Functional Buttons

Home

Edit

Print Credit Note Listing

Click Print Listing > Choose either listing or detail listing.

After select the document, click Preview and select report.