Chapter 4 – Opening Balance Maintenance

Chapter 4.4 – YTD Balance Maintenance

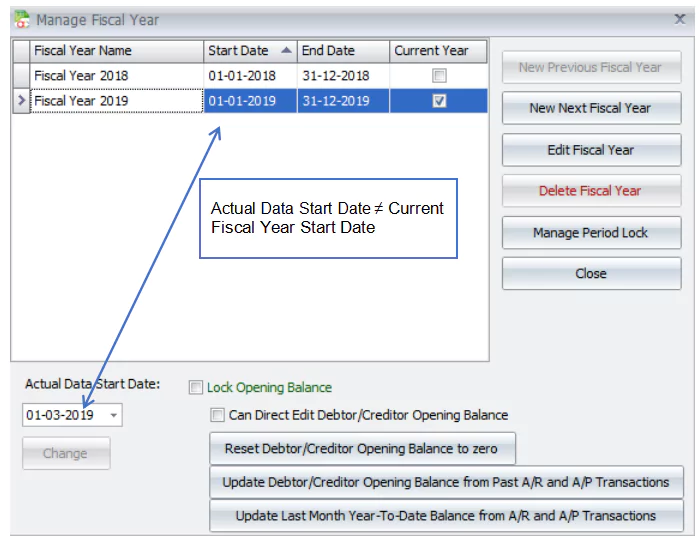

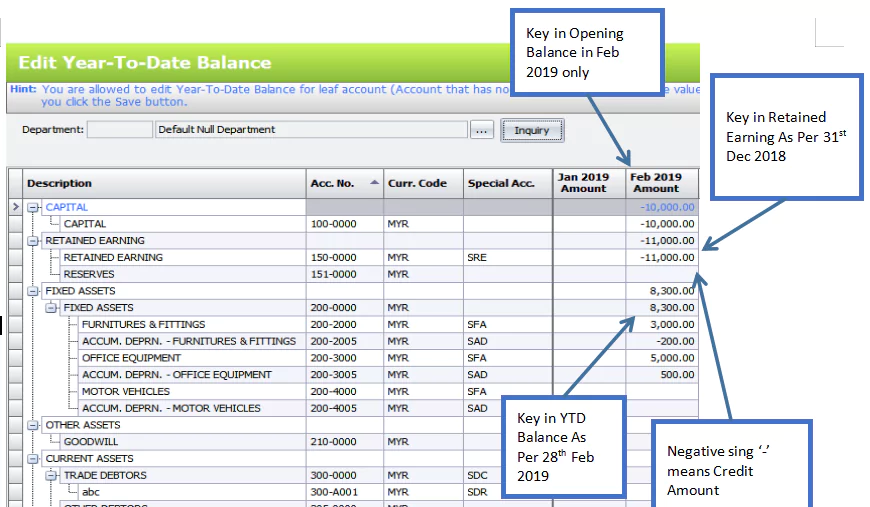

If the Actual Data Start Date is different from the current Fiscal Year Start Date, the total balance will be entered in the month of February 2019 as the YTD Balance.

a) Go to G/L > Year-To-Date Balance Maintenance and enter the YTD balance for March 2019.

Enter the YTD amount into February 2019 only.

Observe the following tips:

- Enter the balance amount just as it appears on your Profit & Loss and Balance Sheet as at February 2019, including the stock value, except for retained earnings.

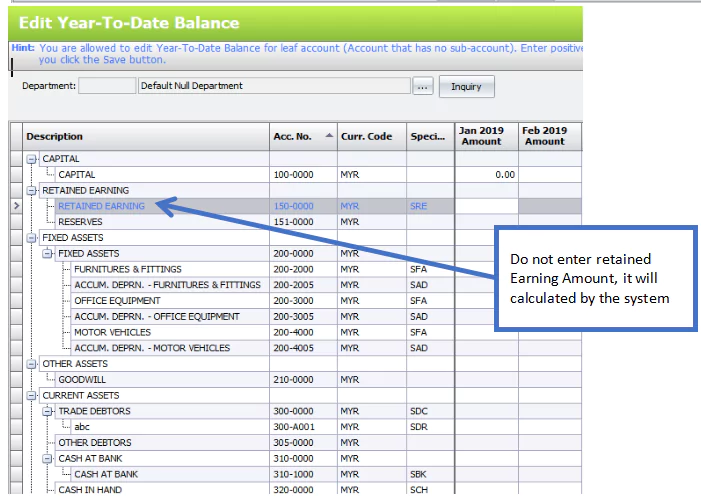

- For retained earnings, enter the value as at the beginning of the current fiscal year. The current year retained earnings (YTD) will be calculated by the system.

- A negative sign (-) means a credit balance, and a positive sign (+) means a debit balance.

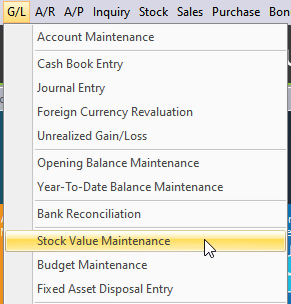

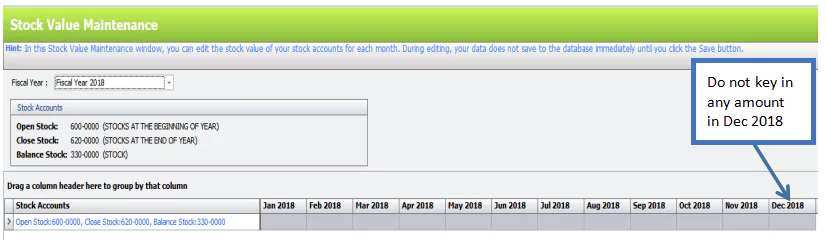

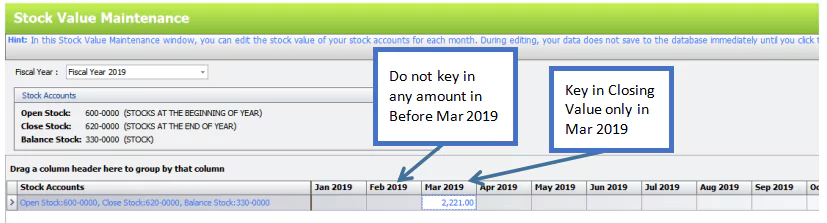

b) Go to G/L > Stock Value Maintenance.