Chapter 4 – Opening Balance Maintenance

Chapter 4.3 – MTD Balance Maintenance

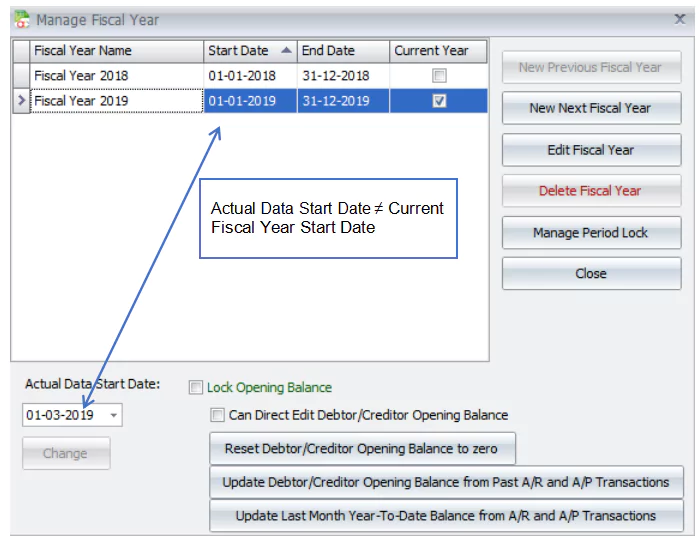

If the actual data start date (January 1, 2019) is not equal to the current fiscal year start date (March 1, 2019), the month-to-date balance for January and February must be entered month by month.

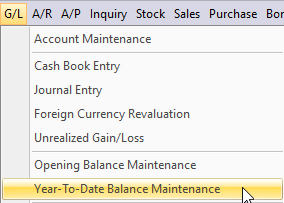

a) Go to G/L > Year-To-Date Balance Maintenance and enter the MTD amount for each month.

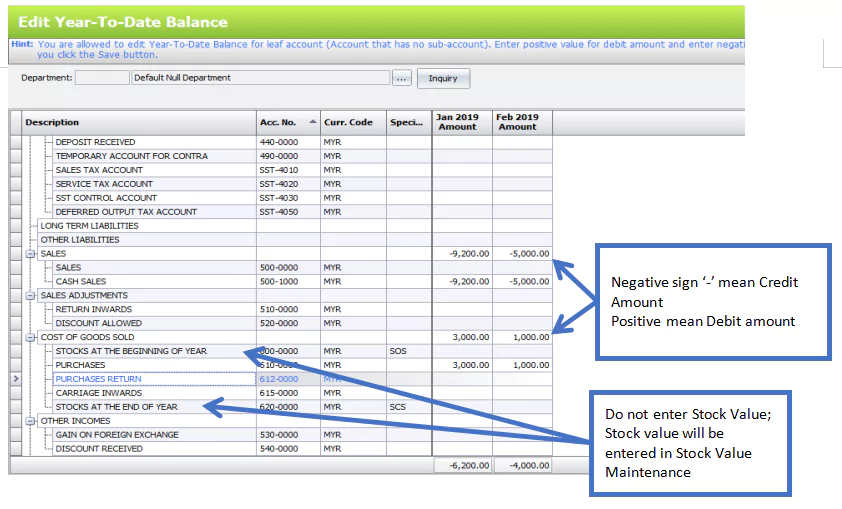

Observe the following tips:

- Do not enter the stock value, it will be entered in Stock Value Maintenance.

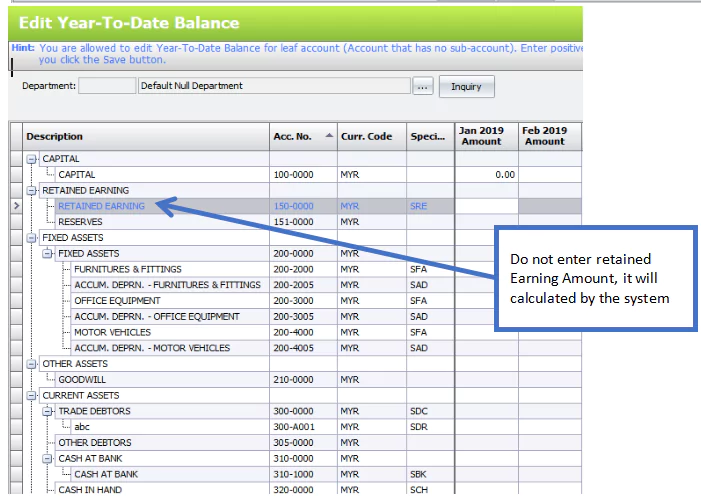

- Do not enter a value for Retained Earning, it will be calculated by the system.

- The negative sign (-) means a credit balance, and the positive sign (+) means a debit balance.

Note:

For account types that are credit balances by nature (such as Liability, Sales, Income, Capital, Accumulated Depreciation, Purchase Return, etc.), negative MTD balances will increase YTD balances, and positive MTD balances will reduce YTD balances.

For account types that are debit balances by nature (such as Asset, Expenses, Purchases, Sales Return, etc.), negative MTD balances will reduce YTD balances, and positive MTD balances will increase YTD balances.

b) Go to G/L > Stock Value Maintenance.