Chapter 7 – Asset Depreciation

Chapter 7.3 – Depreciation Rate Revision

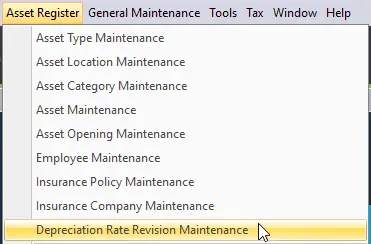

Click Asset Register > Depreciation Rate Revision Maintenance.

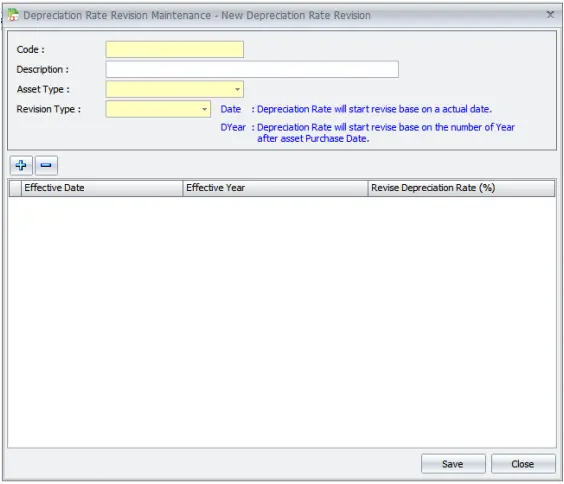

Depreciation Rate Revision for Straight Line Method only.

Code: Key in Depreciation Rate Revision Code for system.

Description: Briefly describe your rate revision code here.

Asset Type: Choose from Asset Type.

Revision Type: Select the revision type, either by Date or by Year.

- Date: Depreciation value will start to be revised based on the actual date.

- Year: Depreciation value will start to be revised based on the number of years after the asset was purchased.

Click to add new depreciation rate revision.

Effective Date: Select an actual date to start revising the rate.

Effective Year: Select the number of years to start revising the depreciation rate.

Revised Depreciation Value: Key in the revised depreciation rate in percentage (%).

Click to save the depreciation rate revision and

to close the window.