Chapter 7 – Asset Depreciation

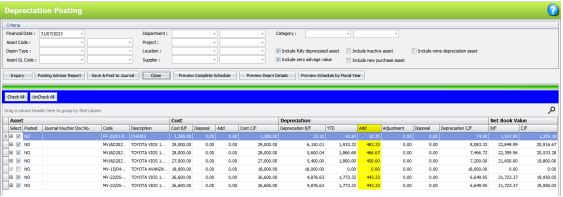

Chapter 7.1 – Depreciation Posting

Click Asset Register > Depreciation Posting.

Fixed assets should be recorded in the general ledger’s asset control account and reconciled with the fixed asset values by posting journal entries as needed.

The following accounts should be created in your general ledger:

-

- Asset Code (Balance Sheet)

- Accumulated Depreciation (Balance Sheet)

- Depreciation Expense (Income Statement)

- Gain or Loss on disposal of asset (Income Statement)

1. You can use criteria to filter data more specifically.

2. Click to list all depreciation details in the listing.

3. Click to drill down the details of the depreciation.

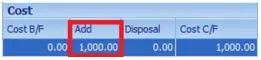

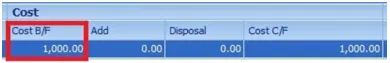

a. Cost

1) Cost B/F

The cost of Assets created in the current financial year Cost > Add column.

E.g: Current Financial Year is 01/01/2022 – 31/12/2022.

For assets created in the financial year 2022, the cost will be shown in Add column.

If you inquire after 31 December 2022, the cost willbe brought forward to the next financial year and shown in the Cost B/F column.

E.g: For assets depreciated and created before 2022, the cost will be brought forward to Cost B/F in 2022.

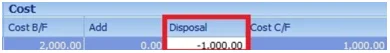

2) Disposal

The value should be Cost B/F or Add – Disposal = Cost C/F. The unit cost will be reversed after disposal.

b. Depreciation

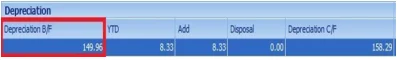

1) Depreciation B/F

For Depreciation B/F, the system will use the Accum. Deprn. B/F from Asset Opening. This value will remain the same for the current financial year.

For the next financial year, the Depreciation B/F will be different. The accumulated depreciation value will be added to the Depreciation B/F from the current financial year.

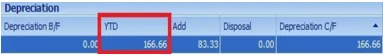

2) YTD

The sum of depreciated value for every month includes current month’s depreciation in current financial year.

The value from Asset Opening Maintenance’s Actual Deprn. YTD will be added, if there is any value in YTD opening.

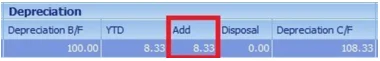

3) Add

The depreciation of current month.

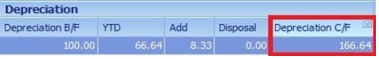

4) Depreciation C/F

The Accumulated Depreciation will be carried forward to next month.

Depreciation B/F + YTD – Disposal = Depreciation C/F.

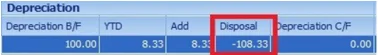

5) Disposal

The accumulated depreciation value should be calculated using the following formula: Depreciation B/F + YTD – Disposal = Depreciation C/F.

If the quantity of an asset is 1, the value of Depreciation C/F will be 0.00 after disposal.

However, if the quantity is more than 1, there will be a Depreciation C/F value for the remaining assets so that they can continue to depreciate.

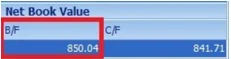

c. Netbook Value

1) NBV B/F

If an asset has been depreciated before the current financial year, the net book value (NBV) of the asset will be brought forward from the previous financial year.

However, if an asset was created and depreciated during the current financial year, there will be no NBV B/F from the previous financial year.

The formula for calculating the NBV B/F is: Unit Cost B/F – Depreciation B/F – YTD = NBV B/F.

2) NBV C/F

There are two possible reasons why the C/F value (carrying forward value) is 0.

i. The asset residual value is 0, which means that the asset has already undergone full depreciation.

ii. The asset has been disposed of.

The C/F value is the net book value (NBV) of the asset carried forward to the next month.

If the asset has been disposed of, the C/F value will be 0.

Otherwise, the NBV will be carried forward to the next month until the asset is fully depreciated, at which point the NBV C/F value will be equal to the residual value of 1.

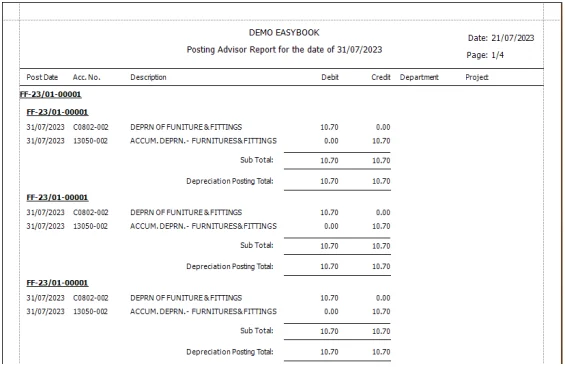

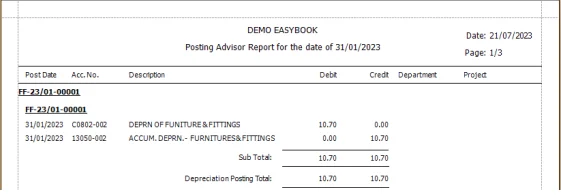

4. Click and check all to view the fixed asset posting advisor report for the financial date you wish to see.

The result of the is shown in the image below.

5. To post the depreciation for an asset, select .

For a clearer understanding of the workflow, please refer to the testimonial.

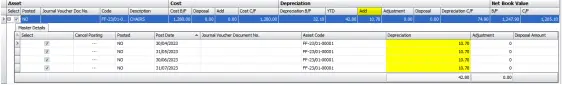

Testimonial

Scenario:

For example, if you are supposed to do depreciation posting for FF-23/01-00001, 01/01/2023, you can select the financial date as 31st Jan 2023, enquire, and you will see FF-23/01-00001, 31/01/2023 listed on the screen. The Posted status will still be shown as ‘NO’ until manual posting is completed.

1) Select 31 Jan 2023 > Click Inquiry > FF-23/01-00001 is showing on the listing.

FF-23/01-00001 is listed, with Posted status as ‘No’ until manual posting is completed.

Click and preview the report to see if FF-23/01-00001 is in it.

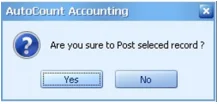

Click > Click ‘Yes’ to proceed.

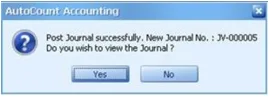

Click ‘Yes’ to view the journal.

The result of the journal entry will be shown as the image below.

The status of Posted will change to ‘Yes’ once the posting is done.