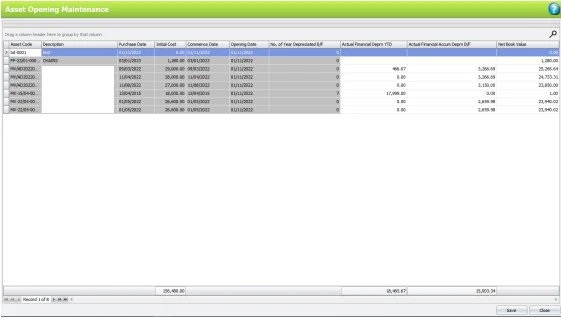

Chapter 5 – Others Maintenance

Chapter 5.1 – Asset Opening Maintenance

You can maintain your fixed asset opening here by entering the following figures:

- System Depreciation Start Date

- Depreciation Year-To-Date Amount

- Accumulated Depreciation on B/F Amount

- Number of Years Depreciation.

After you have changed the information > click Save to proceed.

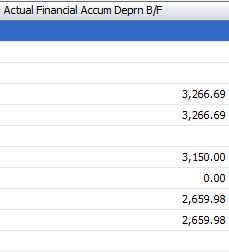

Actual Financial Accum Deprn B/F: The depreciation amount of an asset from its inception until the end of the nearest financial period.

For example, if an asset’s depreciation started on January 2020, the financial period is from 01/01/ 2023 to 31/12/2023, and the system’s depreciation start date is 01/01/ 2023, then the accumulated depreciation B/F is the amount of depreciation that has been accumulated up to December 31, 2022.

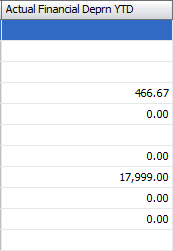

Actual Financial Deprn Year-To-Date: This column is for you to fill up the YTD depreciation for the asset if it is not computerized from the first accounting month or if you have posted the depreciation to the P&L account for the first 6 months.

Then, you need to key in the 6 months’ depreciated value to this column. Otherwise, leave it blank if you start from the first accounting month or if you have not done any posting of depreciation value to the P&L account.

Current financial period depreciation amount until the [system depreciation start date].

Example: Asset depreciation started on January 2021, financial period is from 01/01/2022 to 31/12/2022, system depreciation start date is 01/04/2022.

The accumulated depreciation for January until March is YTD. The accumulated depreciation before January 2022 will be in the actual financial accumulated depreciation brought forward (B/F).