Chapter 2 – Understand the Costing Method

Chapter 2.7 – The Impact of Difference Costing Method

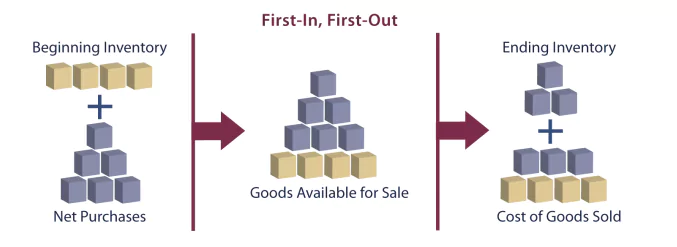

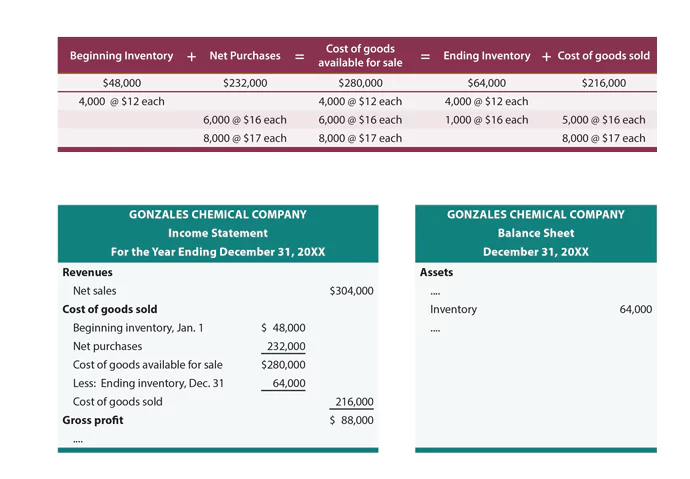

Examine each of the following comparative illustrations to see how the cost of beginning inventory and purchases flows to ending inventory and cost of goods sold.

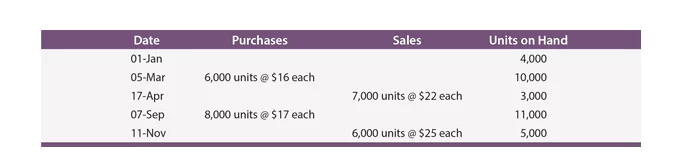

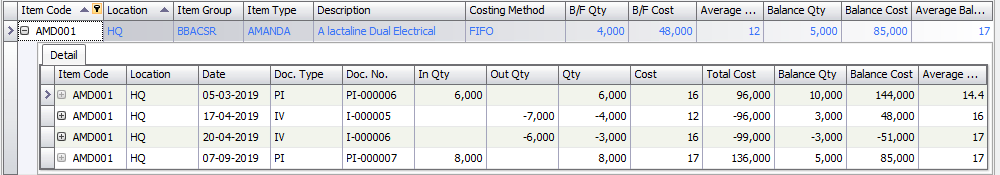

Detailed Example

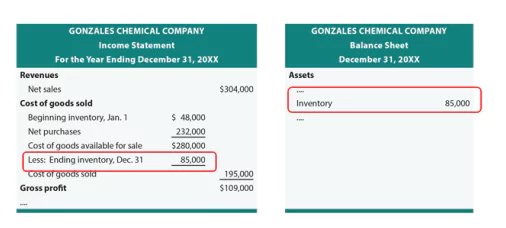

First In, First Out (FIFO)

If FIFO is used, the ending inventory, cost of goods sold, and resulting financial statements are as follows:

Last In, First Out (LIFO)

The ending inventory, cost of goods sold, and resulting financial statements for Gonzales will be as follows if LIFO is used:

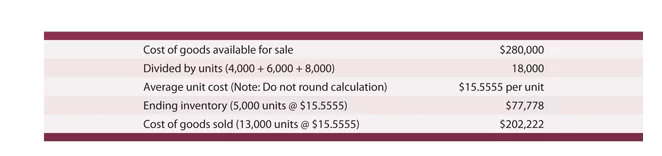

Weighted Average

The ending inventory and cost of goods sold calculations for Gonzales using the weighted-average method are as follows:

These calculations support the following components of financial statements:

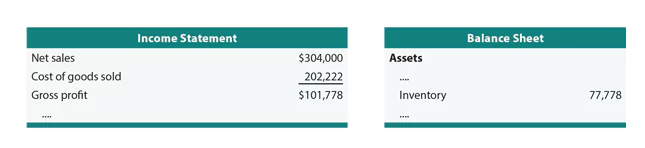

Comparing Methods

The following table shows that the amount of gross profit and ending inventory can vary significantly, depending on the inventory method chosen.

The preceding findings:

- LIFO produces the lowest income (assuming rising prices, as shown in the Gonzales example),

- FIFO the highest,

- and weighted average an amount in between.

- LIFO tends to depress profits, so one may wonder why companies would choose this option. The answer is sometimes driven by income tax considerations:

- Lower income produces a lower tax bill.

- Usually, financial accounting methods do not have to be the same as methods chosen for tax purposes.

- FIFO is better because it reports more recent costs in inventory on the balance sheet.

Regardless of which method is used, the inventory method must be clearly communicated in the financial statements and related notes.

The method of application should be applied consistently.

Even though changes cannot occur, it does not mean that it is impossible.

Changes should not be made unless financial reporting is deemed to be improved.